Biden’s SEC Faces Uphill Fight to Form ESG Reporting Body

The Securities and Trade Fee is poised for a combat with Republicans and company interests as it appears to be to establish uniform policies for how general public companies report environmental, social, and governance issues to traders.

Fight strains are currently being drawn as the SEC gathers feedback on whether or not to designate a new or existing firm to set benchmarks for ESG disclosures or build new reporting guidelines devoid of one particular. Performing SEC Chair Allison Lee suggested previous thirty day period that a criteria entire body could be structured like the Economical Accounting Benchmarks Board.

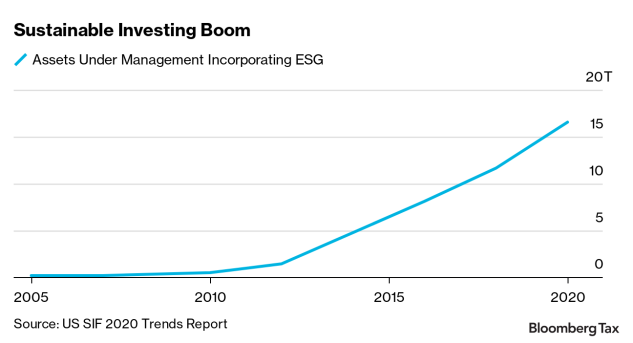

Even though the SEC weighs how and if it need to mandate sustainability reporting, trillions of bucks are flowing into ESG-backed investing. And without the need of distinct rules, traders are remaining to depend on what companies pick to say.

Progressive groups—which have prolonged lamented imprecise and inconsistent reporting on topics these types of as office variety and greenhouse fuel emissions—are urgent the company to take swift action on ESG disclosure benchmarks. But the leading Republican on the Senate Banking Committee states the SEC cannot endorse a standard setter with no congressional authorization.

“Congress ought to reject this kind of an strategy out of hand,” Sen. Pat Toomey (R-Pa.) reported in a assertion to Bloomberg Law. “What issues is no matter if an challenge is financially substance to a sensible investor, not if it conforms to the woke Left’s impression about what is most effective for humanity.”

The SEC very likely would encounter authorized troubles if it made the decision to create a new typical setter or authorize an current one with out congressional acceptance, reported Tyler Gellasch, who was a counsel to previous Democratic SEC Commissioner Kara Stein.

“I hate indicating this is controversial, but it is,” mentioned Gellasch, a fellow at Duke College School of Law’s Worldwide Economic Marketplaces Heart.

March Proposal

Lee has prioritized agency attempts to enrich corporate ESG disclosures due to the fact she took place of work previously this yr, one of various climate-connected targets of the Biden administration. Lee in March requested the community for enter on up coming ways, which include no matter whether to designate a sustainability typical setter.

The general public has right up until June to weigh in. The SEC isn’t expected to acquire motion ahead of then, when the agency most likely will have President Biden’s nominee Gary Gensler as chairman.

The Center for American Development, a progressive assume tank, would like the market regulator to act on its own.

“Whatever way they do it, the SEC wants to start carrying out this,” mentioned Alexandra Thornton, the group’s senior director for tax plan.

The U.S. Chamber of Commerce is skeptical about a conventional setter, said Thomas Quaadman, govt vice president of the Chamber’s Heart for Capital Marketplaces Competitiveness. The small business group has fears about why the SEC would outsource some of its disclosure authority and how a standard setter would purpose.

“The SEC has to assess and offer with a selection of distinct disclosures, which they do, but they do not have a typical setter for,” Quaadman claimed. “Why do we want to do that right here?”

Waiting around on London

The SEC really should hold out to see what transpires throughout the Atlantic, the place global accounting rulemakers are setting up a new sustainability normal-environment board, explained Robert Herz, chairman of FASB from 2002 to 2010.

That new board, backed by the London-dependent Worldwide Monetary Reporting Specifications Foundation, will take on as its initial activity creating guidelines for firms to continually express their local weather modify dangers. It options to lean on operate presently carried out by voluntary groups like the Sustainability Accounting Standards Board.

The SEC has been performing driving the scenes to aid the worldwide venture. And any probable U.S.-dependent effort and hard work need to intently align with all those intercontinental guidelines, claimed John Coates, acting director of the SEC’s Division of Company Finance, in remarks to a securities meeting April 7.

Starting off from scratch in the U.S. ought to be a non-starter, Herz reported. Traders want world-wide advice and a great deal do the job by now has been done.

This solution has the backing of SASB. “We believe the IFRS work is the very best path to obtaining a global set of sustainability requirements and we believe the IFRS effort and hard work should also leverage what presently exists,” SASB CEO Janine Guillot reported.

A Menu of Alternatives

A different choice could contain the SEC asking FASB’s father or mother group, the Economical Accounting Foundation, to established up a new panel in the foundation’s Norwalk, Conn. headquarters.

The foundation in September despatched a survey asking irrespective of whether it really should deal with sustainability issues or established up its personal board. But that provides a bevy of logistical issues.

“Who’s going to fork out for it?” said Terry Warfield, accounting professor at the Wisconsin University of Organization at the College of Wisconsin and previous member of the FAF board of trustees.

Efforts to standardize sustainability reporting in the U.S. could get to considerably over and above greenhouse gasoline emissions or how companies perspective and deal with their employees. New specifications could go over corporate political shelling out or how significantly enterprises pay back in taxes to jurisdictions all-around the world.

Lots of organizations already voluntarily report on some of people figures. Requiring the reporting in regulatory filings would have to have far more intense oversight of how that data is developed and at minimum some degree of evaluation by auditors.

The markets would reward from an corporation that understands how any ESG specifications interact with accounting and other reporting and that will strike a equilibrium amongst investor pursuits and preparers’ capacity to produce, claimed Benjamin Edwards, an affiliate law professor at the University of Nevada at Las Vegas.

“You would not want an entity that is entirely captured by the business to established toothless expectations. That currently being mentioned, what we also do not want is a ham-handed approach that drives up price,” he reported.

Fairly than relying on the SEC to instantly generate any new disclosure guidelines, institutional buyers and even some firms would choose an unbiased entity identical to the FASB to have that job, indicating it would be considerably less inclined to political interference.

The existing alphabet soup of frameworks and voluntary typical setters frustrates traders and firms, explained Bob Laux, who previously worked for the International Integrated Reporting Council, and who is now an affiliate director for the Practising Legislation Institute.

It’s going to acquire an outside the house authority, like the SEC, to carry it all jointly, he said.

Coates urged get-togethers not to wait right until the June deadline to comment on the SEC’s disclosure designs. In certain, Coates said he would like to listen to tips for how an ESG typical setter ought to run and who really should oversee it.