China Is Aggravated by the Way too-Rather Accounting of Indebted Home Builders

China’s distressed real estate builders have survived several blood baths. At any time ambitious despite their indebtedness, they’ve deployed nimble practices to tackle Beijing’s policy clampdowns. Often, nonetheless, it does not spend to be as well suave.

Beijing is tightening the noose yet again with the so-identified as “three red traces,” regulatory borrowing limits formulated final August that builders must meet: A 70% ceiling on liabilities to assets, a 100% cap on web financial debt to equity, and dollars to cover small-expression borrowing. Failing those people wide guidelines, businesses could see their onshore funding channels shut altogether.

On paper, builders appeared compliant. By 2020 yr-finish, seven out of 17 tracked by Bloomberg Intelligence analyst Kristy Hung by now confirmed enhancement in their metrics from 6 months previously. In early June, China Evergrande Group, the nation’s most indebted, promised to satisfy at the very least 1 of the three metrics by the end of the thirty day period.

The fact is a great deal murkier. In the previous year, companies have utilized their connections in Hong Kong to situation sizable off-harmony-sheet dollar bonds, and deployed convoluted company structures to hide financial debt in buy to meet up with Beijing’s new funding principles. Joint ventures, for occasion, came in helpful. Land auctions can be high-priced so developers have incentive to group up with financial traders who are not third-celebration friends. The accounting reward of partnerships in which the developers maintain minority curiosity is that they can be regarded as fairness in its place of liability. The house moguls can consolidate the projects once they’ve come to be funds cows.

Aside from prettying up the equilibrium sheet and passing Beijing’s 3 red lines, this joint-undertaking structure permits companies to count on money contributions from its companions to finance its expansion, in its place of seeking debt funding from the broader marketplace.

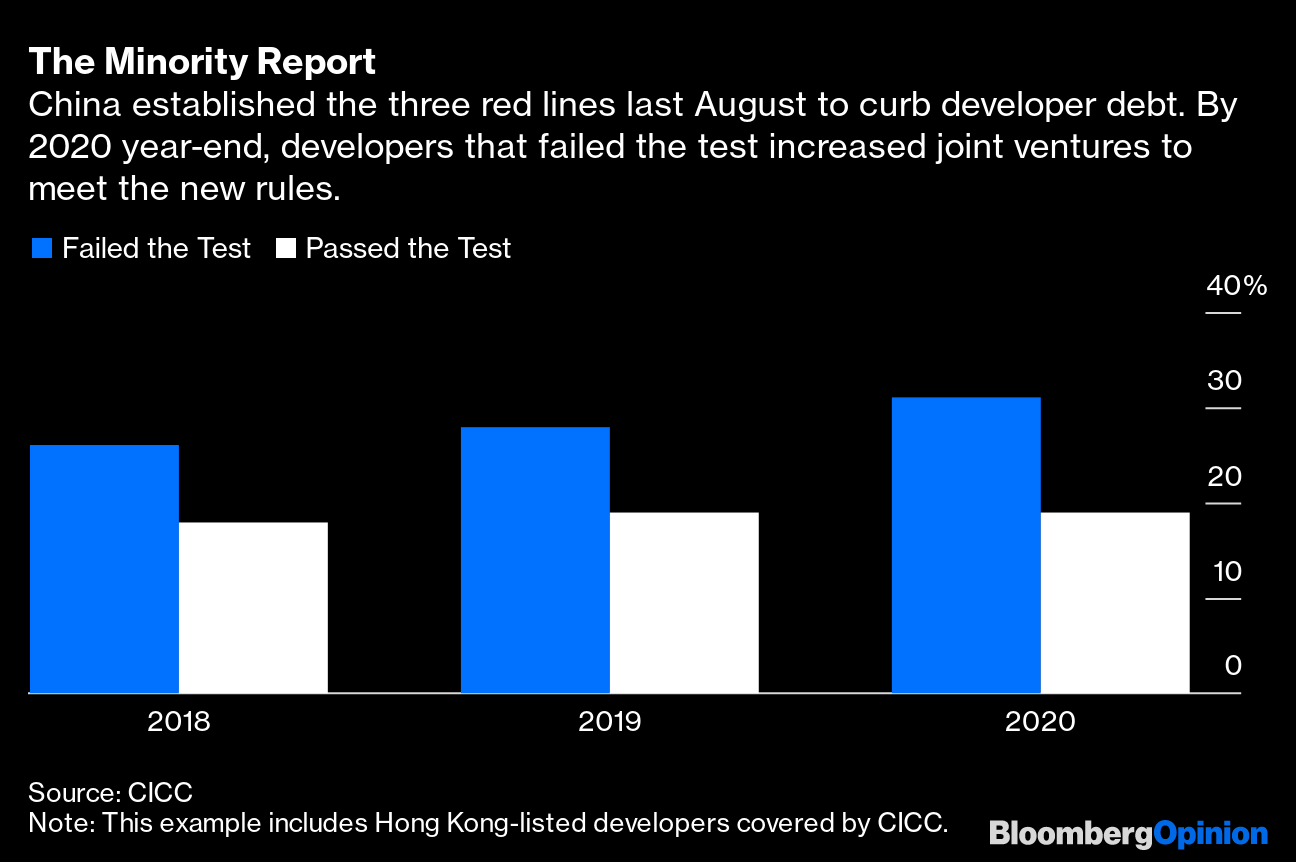

About the past year, there’s been a surge in minority pursuits in the shareholder combine, a evaluate of how significantly joint venturing there could be. Builders that unsuccessful the three red lines in August observed that ratio increase to 31% by the stop of 2020 from 28% a calendar year before, while the shareholder combine of those that handed the take a look at barely budged, info presented by CICC show. S&P Worldwide Ratings, which tracks a more substantial established of businesses, notes that minority interests now account for 39% of a median company’s complete equity, up from only 14% 5 several years earlier.

The Minority Report

China founded the a few red traces last August to control developer credit card debt. By 2020 calendar year-conclude, builders that failed the examination greater joint ventures to meet up with the new rules.

Source: CICC

Lately, markets have caught on to this maneuver and are now focusing on the top quality of developers’ balance sheets. Bond traders began dumping companies that relied on joint enterprise associates as crucial funding sources.

It commenced in late March with a profit warning from midsized Yuzhou Group Holdings Co Ltd. The enterprise, a prolific person of the joint enterprise construction, blamed auditor Ernst & Young’s “strict” standard — such as requiring documents that showed the developer in fact managed its joint ventures — just before allowing for it to shift related initiatives on to its harmony sheet. Previous yr, although contracted property sales, which incorporate contributions from its joint ventures and associates, rose 39.7% to 105 billion yuan, Yuzhou’s actual income on the earnings assertion tumbled by 57% to only 9.7 billion yuan. It was not ready to consolidate sales of its additional financially rewarding initiatives for the 12 months.

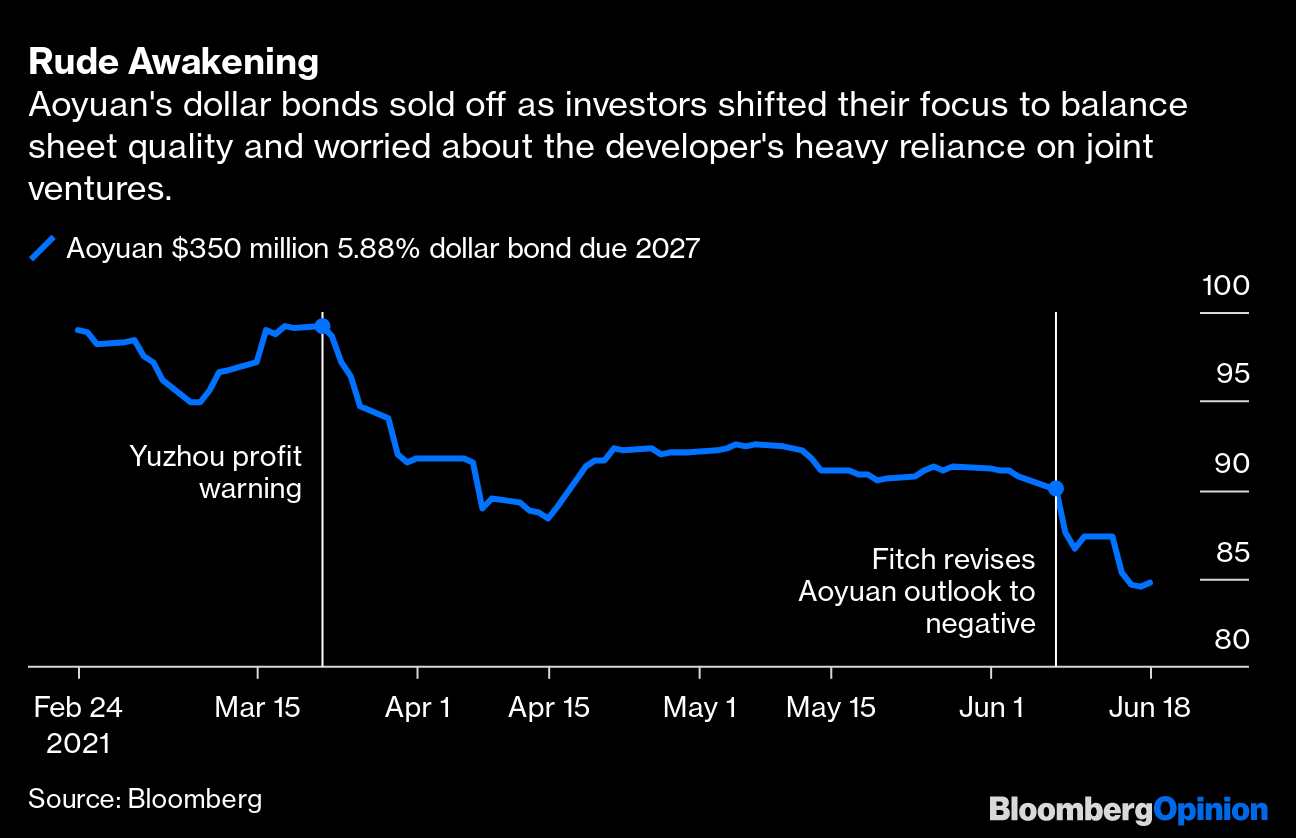

There was seemingly fast spillover. China Aoyuan Team Ltd., for instance, witnessed a substantial selloff. Its $350 million 5.88% greenback bond, issued as not too long ago as late February, is now trading at 85 cents on a greenback. Past calendar year, minority fascination at Aoyuan jumped to account for 66% of its overall equity, from 59% a yr previously, the enterprise disclosed a 7 days following Yuzhou’s income warning. Others that rely intensely on joint ventures, this sort of as Sichuan Languang Development Co. Ltd., acquired marketed off much too.

Impolite Awakening

Aoyuan’s dollar bonds sold off as traders shifted their concentrate to harmony sheet top quality and concerned about the developer’s significant reliance on joint ventures.

Source: Bloomberg

With Beijing casting a sharper eye on accounting maneuvers, a distressed developer without the need of total management of a job will not be able to promote as effortlessly as in the earlier to enhance liquidity. Meanwhile, scores organizations are closing in. A quarter of rated developers with sizeable minority pursuits might encounter downgrade pressure if these equity stakes are reclassified as small-time period personal debt, S&P warned this thirty day period. High-generate developers extended accustomed to the voracious urge for food of Hong Kong’s dollar bond sector may well abruptly see this doorway shut, too.

Beijing is not happy. Its 3 red lines were meant to steer developers absent from their recurring financial debt-fueled growth. It’s not a lengthy lawful document that spells out all the do’s and don’ts. Developers are not intended to exploit the loopholes.

As much more analysts and media retailers examine the perils of off-harmony-sheet funding, China will take recognize. Previously this year, Beijing’s watchdogs commenced asking large developers to post every month leverage stories that contain joint ventures’ financial debt ailments, noted S&P. More than time, additional developers might have to do the exact same. It’s far better to obey the policies — in spirit and real truth.

This column does not automatically replicate the viewpoint of the editorial board or Bloomberg LP and its entrepreneurs.

To speak to the editor accountable for this tale:

Howard Chua-Eoan at [email protected]