Crypto Discussion: Is There AMPL Prospect for Speedy Traders?

What is Very hot in Crypto this 7 days?

It’s Ampleforth (AMPL). This is the second premier algorithmic stable coin immediately after Vacant Set Dollar (ESD), in conditions of market cap.

But let us again up. What is an algorithmic stable coin? Initially, a secure coin is — as the name implies — backed by a reserve asset for included balance. In this scenario, even so, the AMPL coin also relies on algorithms to equilibrium the circulating supply of the asset. In uncomplicated conditions, the algorithm problems extra coins when price tag improves, and purchases them off the industry when the cost falls.

For example, suppose a secure coin is priced at $1. When the rate drops to $.80, an algorithm acknowledges the imbalance in between offer and need, and mechanically sets a market purchase buy to drive the cost back. In circumstance the rate goes above $1, the algorithm sells belongings to retain the price on the predefined amount that keeps the peg.

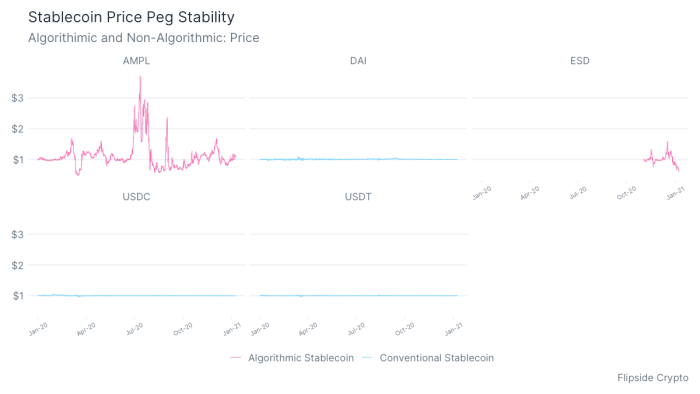

The other styles of secure coins include fiat-collateralized kinds, like USDC and USDT, which are backed by economic establishments and crypto-collateralized, like DAI, which are backed by a single or quite a few electronic assets, alternatively of funds, such as ETH and BAT.

Why is AMPL hot?

AMPL is intended to be pegged to the U.S. dollar — with daily “rebases” to stabilize cost. The supply adjustment is manufactured by inflating or deflating the holdings of each and every AMPL wallet. This is very important, due to the fact it signifies that the benefit of a user’s holdings fluctuates with the marketplace capitalization of AMPL.

The major argument that Ampleforth makes for this counter-cyclical actions is that the incentive to market rises as prices increase, and the incentive to acquire will increase when the AMPL cost decreases. This is meant to produce an arbitrage prospect for rapidly traders to earnings prior to the sector rate of AMPL has time to modify.

What is Flipside’s Take?

AMPL has been all over for a yr and has experienced the hardest time preserving its peg — growing all the way earlier $3 in July 2020.

The spike in cost in July aligns with Ampleforth’s start of “Geyser” — an incentive plan that dispersed rewards in AMPL for people who equipped AMPL-ETH liquidity on Uniswap, a non-custodial decentralized trading platform. That start was on June 23.

In addition to earning Liquidity Company fees on Uniswap, users who offered AMPL-ETH liquidity could get their Liquidity Provider tokens and stake them on the Geyser system, thereby earning an even higher share of AMPL rewards. Lastly, users were being also rewarded for not withdrawing their deposits. All of which inevitably created a flood of curiosity in Ampleforth.

It is crucial to notice, however, that algorithmic stable cash are very new and these projects are positioned as experiments to mature and increase the decentralized finance place. It will be attention-grabbing to see over time how they regulate in purchase to attain the goal of algorithmic steadiness with no collateral or debt supporting it.

The Flipside Crypto Asset Score Tracker delivers institutional and innovative retail buyers the potential to track about 500 cryptocurrencies’ fundamentals. FCAS Tracker is currently cost-free to a select group of new people as it proceeds to produce the merchandise. Go to Flipside below to achieve entry to Flipside Analytics.