EU sustainable finance reforms offer an fascinating option for asset supervisors

A seismic industry change in state of mind and behaviour, along with new regulation and regulation, is driving an evolution of Environmental, Social and Governance methods, with ESG resources predicted to a lot more than triple in asset size by 2025 and maximize their share of the European fund sector from 15 to 57% (PwC investigation, noted in the FT).

The EU has introduced a package deal of sustainable finance reforms that have an effect on EU corporations and those wanting to do organization in the EU. The Disclosure Regulation and Taxonomy Regulation both equally implement to “financial sector participants”, which includes AIFMs, UCITS ManCos and MiFID investment decision corporations delivering portfolio management suggestions. For the reason that of the scope and application of the proposed principles that encompass these two crucial measures, it is also predicted that professionals who are (or who regulate cash) exterior the EU will also want to comply with a lot of of the measures if they wish to marketplace their items to EU investors. To help reach easy implementation of the new policies across their organisations and merchandise, we would spotlight a few vital motion and realistic details for asset professionals.

- A scoping exercise: There are greater disclosure and other obligations for individuals firms that have a sustainability aim as portion of their business. This includes companies obtaining to differentiate in between their internet marketing of “Article 8” products (that endorse environmental and/or social qualities) and “Article 9” merchandise (that have a sustainable expenditure goal). In addition, firms that are categorised as “large” will have to comply earlier than other people (in June 2021).

- A strategic strategy: The extent that a agency incorporates ESG into its companies will condition its approach, although guaranteeing that governance, policy and chance problems are taken into account. For case in point, Article 8 and 9 products that are in scope of the Taxonomy Regulation (ie they add substantially to a person or much more of the Regulation’s 6 Environmental Goals) will will need to make supplemental disclosures, comply with certain safeguards and ensure the “do no substantial harm” theory applies to all those investments that consider into account sustainable economic activities.

- A holistic solution: Corporations will need to have to combine other sustainability requirements (as could be recommended beneath AIFMD, MiFID II, UCITS Directive, Insurance policy Distribution Directive and Solvency II) with sector most effective practices as might be pertinent on a sectoral degree. For example, MiFID companies are essential to integrate sustainability choices into the product oversight and governance approach. Financial commitment advisers and discretionary administrators will also be expected to talk to customers about their ESG tastes for the duration of the suitability assessment which is expected to generate increased desire in sustainable goods. AIFMs are to make sure that sustainability pitfalls and sustainability components are built-in within just their organisational, operating, risk administration and because of diligence procedures.

- A resilient approach: The principal guidelines below the Disclosure Regulation occur into impact on 10 March 2021, albeit that the publication of and compliance with the remaining Stage 2 measures has been delayed (with 1 January 2022 staying the anticipated new compliance deadline for the preliminary established of RTS). This is probable to outcome in a two-tier tactic and getting to re-take a look at disclosures and other obligations once the Stage 2 steps are finalised. A different difficulty for Uk firms influenced is to what extent the “in-flight” legislation will use at the conclusion of the transitional time period. In our look at, it appears not likely that the United kingdom will want to materially diverge its rules with individuals of the EU, and at the very least want to be able to facilitate organization continuity for cross-border fund operations. At last, the lack of any grandfathering at the minute suggests that firms will need to have to assess and classify existing resources/products as very well as people currently being produced.

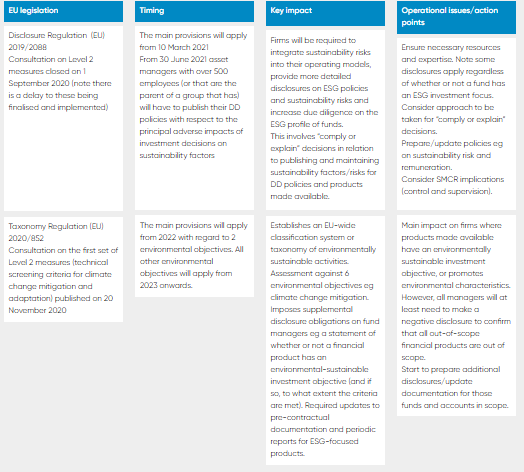

The desk down below sets out the wide application and critical impacts of the main EU legislative offer (we have not integrated any particulars on the proposed delegated acts that integrate sustainability needs into other directives). We also talked about the proposals and precisely how they effect asset supervisors throughout our Emerging Themes webinar on 26 January 2021.

We assume the recent COVID-19 crisis to boost the urgency of troubles that will need to be resolved, and convey a renewed aim on social and governance troubles – for instance, in conditions of how organizations take care of their employees, suppliers and interact with their communities, as nicely as restoration funding remaining linked to reaching social very good.

THE UK’S Method:

Nikhil Rathi, the FCA’s CEO, spoke at a Environmentally friendly Horizon Summit in November 2020 about the FCA deepening its sustainable finance strategy in buy to travel most effective apply and support the changeover to internet zero, and the significance of collaboration with other regulators, the Governing administration and market to realize this. We would attract out three themes which present beneficial markers for the UK’s envisioned method in this location. To start with, the FCA has extended and accelerated its designs to introduce mandatory weather-linked money disclosure specifications for mentioned issuers and huge asset owners that are aligned to the Taskforce on Local climate-associated Monetary Disclosures’ (TCFD) tips. For asset administrators, along with daily life insurers and FCA-controlled pension suppliers in the British isles, the FCA intends to seek the advice of in the very first 50 % of 2021 on proposed new disclosure policies. The TCFD’s Taskforce Roadmap expects 75% of asset managers to be covered by the regulatory/legislative necessities for TCFD reporting in 2022, growing to 96% by 2023.

Secondly, the Govt has announced its have United kingdom taxonomy for identifying which activities can be described as environmentally sustainable, and that this will choose the scientific metrics in the EU taxonomy as its basis. Thirdly, whist referring to “interactions with similar worldwide initiatives, which include those people that derive from the EU’s Sustainable Finance Motion Plan” one particular could very easily infer that the British isles has extra formidable regulatory and marketplace aims than the EU in this place.

Summary

Our look at is that these ESG developments supply an fascinating option for asset administrators throughout all asset classes and sectors – whose actions can unlock expense opportunities and have tangible results on financial prosperity and the health and fitness and wellbeing of stakeholders.

While not without challenge, embracing sustainable expenditure ideal procedures, along with implementation of the regulatory initiatives, will support drive scrutiny of financial commitment items and steer clear of possibly problematic professional and regulatory implications of greenwashing and misleading products labelling.