Greensill and supply-chain finance: how a contentious funding resource will work

Because it was established a decade back, Greensill Money has developed explosively to develop into a single of the greatest providers of offer-chain finance.

But the group, which is backed by SoftBank and encouraged by former United kingdom prime minister David Cameron, is now racing to strike a rescue offer just after Credit Suisse froze $10bn of funds joined to the organization.

The crisis has turned the spotlight on offer-chain finance, a controversial approach that has drawn the ire of regulators, rating agencies and accountants.

What is offer-chain finance?

It is often identified as “reverse factoring”, due to the fact it is a new spin on a hundreds of years-aged procedure of raising cash from invoices.

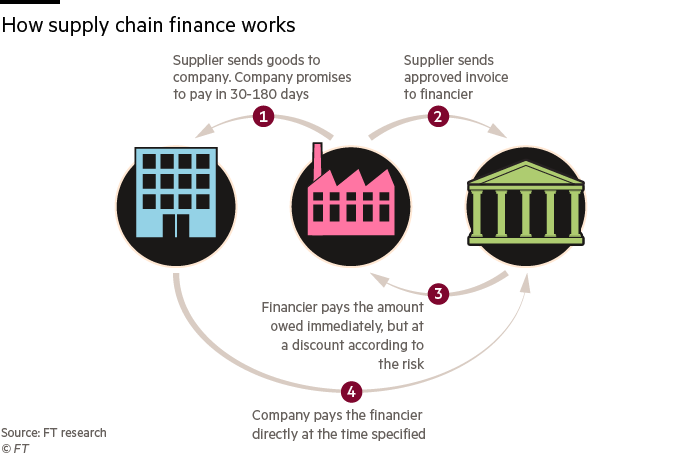

In useful terms, the system includes a financial establishment agreeing to pay back the costs a company owes to its suppliers. The trade-off for the suppliers, routinely scaled-down corporations with significant multinational clientele, is that they get paid rapidly, albeit a bit a lot less than they are owed.

The fiscal establishment later collects the total sum of the bill from the significant company, which is in outcome paying a smaller price to clean its lumpy payment schedules.

Greensill arranges this sort of funding for companies possibly through a lender it owns in Germany or by packaging these supplier bills up into bond-like investments for the Credit rating Suisse cash. It would make funds from staying the middleman amongst companies and buyers.

The business also does standard factoring — in which a enterprise sells on its shopper invoices at a low cost.

Why is it controversial?

The brief reply: its accounting procedure.

Even though a organization that uses supply-chain finance owes funds to a financial institution, accountants do not course these services as debt. As a substitute a organization commonly publications the revenue owed in the “trade payable” or “accounts payable” line of its harmony sheet, mingled in with all the other charges owed to suppliers.

Whilst a footnote to the accounts may demonstrate how a great deal of this line is designed up of dollars basically owed to economic institutions, alternatively than suppliers, there is no prerequisite to disclose it.

The deficiency of disclosure has troubled equally score businesses and regulators, including the US Securities and Exchange Fee. The Big Four audit companies also wrote a joint letter to US accounting watchdog FASB in 2019, asking for “greater transparency and consistency” in fiscal disclosures.

Why can it show unsafe for providers?

Offer-chain finance is a authentic and progressively frequent tool for large multinational organizations.

But the lack of disclosure indicates that it has also proved preferred with struggling corporations searching to mask their mounting borrowings. When nervous loan companies yank these facilities from greatly indebted businesses, it can create an influence comparable to a bank-operate on their performing funds posture.

Supply-chain finance was at the heart of the 2015 collapse of Spanish clean up electricity corporation Abengoa. Greensill organized funding for the Spanish firm as a result of an off-balance-sheet car.

In advance of its demise in 2018, British isles building group Carillion made heavy use of the government’s offer-chain finance programme. MPs investigating the outsourcer’s demise mentioned the scheme permitted it to “prop up its failing company model”.

When Carillion was not a consumer of Greensill, Lex Greensill, the finance company’s founder, helped devise the governing administration scheme it drew on when he labored as an adviser to then key minister Cameron in 2012.

Possibly toxic for weak businesses, source-chain finance can be a gold mine for limited sellers who comb by means of corporate filings hunting for its too much use. When US hedge fund Muddy Waters released a report alleging fraud at healthcare facility operator NMC Wellbeing in December 2019, it involved references to the FTSE 100 company’s use of the Greensill-joined Credit rating Suisse resources.

Less than six months just after the report, NMC filed for administration.

Did Lex Greensill invent source-chain finance?

Lex Greensill, a 44-year-previous previous financial commitment banker, has claimed that the plan for his company was formed by his encounters developing up on a watermelon farm in Australia, wherever his family members endured financial hardships when huge businesses delayed payments.

But he did not invent supply-chain finance — banking institutions in the US and Europe have supplied this form of financing to shoppers for a long time.

However, his company has been at the chopping edge of developing even much more difficult structures for certain corporations. The FT unveiled very last 12 months that SoftBank experienced poured extra than $500m into the Credit rating Suisse resources, which then built huge bets on the personal debt of struggling start off-ups backed by the Japanese technological know-how conglomerate’s Eyesight Fund.

Greensill was at the coronary heart of this circular stream of funding, possessing the two sourced the assets for the fund, as nicely as counting SoftBank’s Vision Fund as a single of its have shareholders.

What transpires to Greensill’s clientele?

That relies upon. Credit score Suisse’s $10bn fund freeze signifies it is no lengthier able to commit in new supply-chain finance paper, which could in principle throw a company’s funding into turmoil.

Shoppers these types of as Vodafone and AstraZeneca with solid financial investment-quality scores will use quite a few unique source-chain finance providers and really should have small problems getting desire somewhere else.

Together with taking into consideration a offer to get some of Greensill’s working property, private equity organization Apollo is wanting to consider about some of these useful provide-chain funding relationships with blue-chip firms, via one of its coverage affiliate marketers.

But reduce-rated businesses without broader accessibility to funding may well encounter a bumpier ride. Sanjeev Gupta, a British industrialist and just one of Greensill’s closest consumers, is under specific scrutiny.

German money regulator BaFin is pushing Bremen-primarily based Greensill Financial institution to decrease its publicity to Gupta, right after probing the bank’s balance sheet and increasing problems all over the degree of risk linked to a solitary consumer.

Apollo has especially ruled out having on any funding for the Indian-born industrialist. Gupta’s efforts to borrow hundreds of thousands and thousands of dollars from Canadian asset supervisor Brookfield have also foundered.

A spokesman for Gupta’s GFG Alliance reported it “has ample funding for its recent needs and its refinancing designs to broaden its money foundation and get for a longer period term funding are progressing well”.