Greensill scenario could result in reduction of self-assurance in source chain finance market

Amid information of investors suspending funding to Greensill Cash (United kingdom) Ltd., business gamers fear it could result in a ripple effect on the provide chain finance marketplace as a complete, to the detriment of small businesses in require of liquidity now more than at any time.

While provide chain finance has faced controversy all around its accounting remedy and usage, the method itself is not to blame for Greensill’s difficulties, they stated.

Greensill is reportedly getting ready for insolvency soon after Credit history Suisse Group’s fund administration arm and Swiss asset supervisor GAM Holding AG this 7 days introduced they had frozen money connected to the U.K.-centered lender.

For other provide chain finance gamers, this is “truly terrible timing,” with the market presently working with reputational difficulties and the coronavirus pandemic, mentioned Erik Hofmann, a professor at the Institute of Supply Chain Management of the College of St. Gallen in Switzerland.

The Greensill situation could set off “a fatal decline of assurance” in offer chain finance, most likely starting a “domino effect” of buyers withdrawing funding, Hofmann mentioned in an job interview.

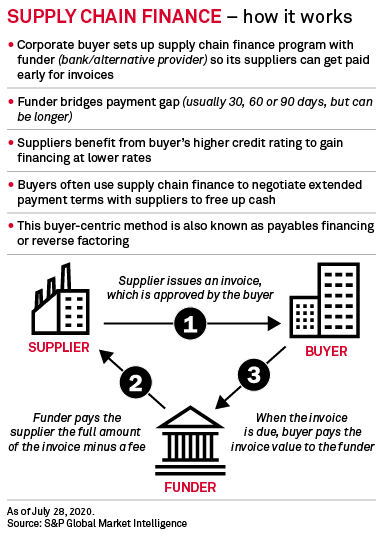

Source chain finance includes several financing applications, but the time period is frequently utilized to explain what is also known as reverse factoring, a approach in which a corporate buyer companions with a lender or choice service provider to allow for suppliers to be compensated early for their invoices.

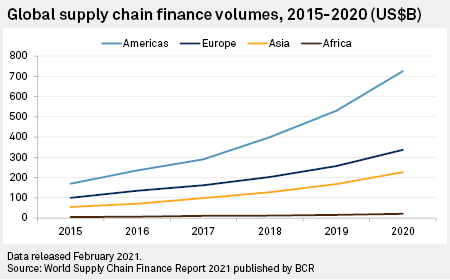

The sector has grown drastically in current yrs, to a full benefit of $1.31 trillion in 2020, according to the most current World Supply Chain Finance Report, posted by intelligence corporation BCR very last thirty day period. In 2020 by itself, source chain finance volumes grew 35%.

Reputational difficulties

Even though banking companies remain the largest loan companies in this space, Greensill, as an different provider, has played an vital job in bringing the asset course to personal investors. The organization arranges provide chain finance plans specifically with corporates, then offers and sells the assets to traders through resources.

Just last month, Bloomberg heralded Lex Greensill, the company’s founder, as “the king of source chain finance.”

“Greensill actually did set this strategy on the map. They are worthy of kudos for that,” explained Tony Brown, CEO of The Trade Advisory, a trade finance consultancy, in an job interview.

But with Greensill now in economic difficulties, Brown reported it could prompt investors to problem offer chain finance as an instrument.

|

“When a little something like this takes place, it deflates the enthusiasm that ordinarily should really exist for this method. I fret that it will scare off some investors who otherwise must be captivated to the place,” he said.

Offer chain finance has presently come beneath fireplace in latest a long time, criticized for remaining utilized by some firms to push their suppliers to settle for unusually lengthy payment phrases. Furthermore, since it is recorded in the corporate’s accounts as “trade payables” relatively than economical credit card debt, credit rating rating companies have warned it could conceal a firm’s genuine money leverage.

In earlier situations, businesses have prolonged payment terms to suppliers up to pretty much a total calendar year, making a substantial working cash profit “with no any recognition of borrowings,” according to an S&P Global Rankings report revealed last yr.

Fitch Rankings has claimed that this “classification loophole” was a “important contributor” to the liquidation of British development big Carillion in 2018 simply because it veiled some of its money challenges.

The source chain finance industry definitely faces structural troubles it needs to address, each close to the instrument’s accounting remedy and ethical inquiries on how companies really should be utilizing it, reported Hofmann. But these specific issues are not linked to Greensill’s current issues, Hofmann reported.

The driving force behind Credit rating Suisse’s funding suspension relates to fears about Greensill’s exposure to a one shopper, the U.K.-primarily based metal magnate Sanjeev Gupta, The Wall Street Journal documented. Lapsing coverage insurance policies, which give traders consolation that their dollars is safe, was supposedly one more variable.

“There are so lots of great matters about offer chain finance,” said Steven van der Hooft, CEO of supply chain finance consultancy Capital Chains, in an job interview.

This sort of finance is notably useful for modest and medium-sized enterprises as it gives them access to funding that may possibly have or else been unavailable to them, and at a lot more affordable costs since the price is primarily based on their buyer’s credit score ranking. Supply chain finance will be critical to serving to these providers restart their actions as economies reopen soon after the pandemic, van der Hooft mentioned, anticipating an “enormous want” for the solution in the coming yr.

Van der Hooft, also, argues that the provide chain finance product alone is not to blame for the challenges at Greensill, but he is anxious that the instrument will experience even further criticism subsequent current developments. A prospective ripple result could trigger liquidity to dry up in equivalent systems and leave suppliers, especially SMEs, without the need of obtain to funding, van der Hooft mentioned.

Economic disaster forward

The coronavirus pandemic and its financial aftermath could further more include gasoline to the fire. Hofmann stated government assist measures are currently offering a “protecting defend” for quite a few corporations, and the scaling back again of this kind of efforts is very likely to guide to additional insolvencies.

This not only poses a danger of losses inside source chain finance, but is possible to also effect the possibility urge for food of credit rating insurers, Hofmann mentioned, adding an additional hurdle for offer chain finance schemes relying on credit history coverage as protection from default.