Investors Pour Money Into Lipper General U.S. Treasury Funds Despite Performance

[ad_1]

Douglas Rissing/iStock through Getty Visuals

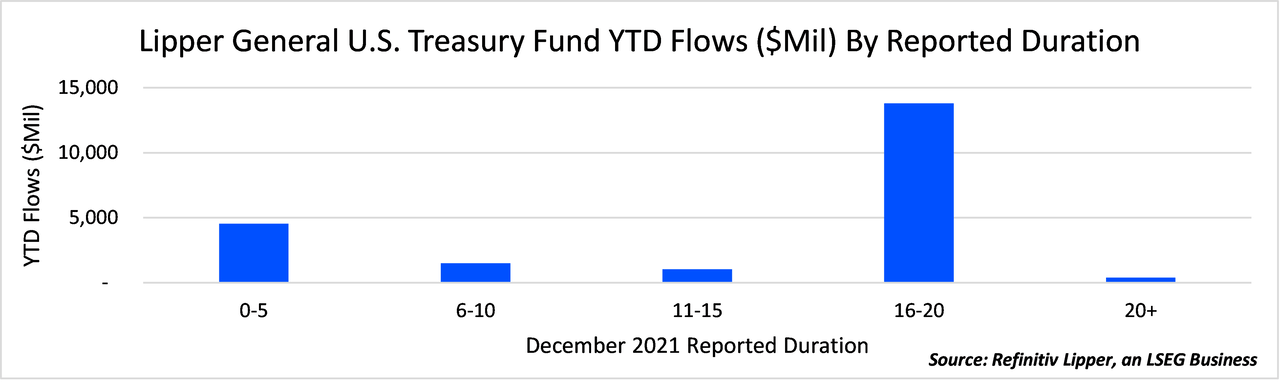

The Lipper Common U.S. Treasury Funds classification consists of funds that commit generally in U.S. Treasury costs, notes, and bonds. The funds in just this classification had an typical period of 12.2 many years as of December 2021.

In contrast to other key fastened profits indices like the Bloomberg Municipal Bond Full Return Index (-8.8%) and the Bloomberg U.S. Mixture Bond Complete Return Index (-9.5%), Lipper Typical U.S. Treasury Money have posted a really underwhelming calendar year-to-day effectiveness through April thirty day period conclude of adverse 13.3%.

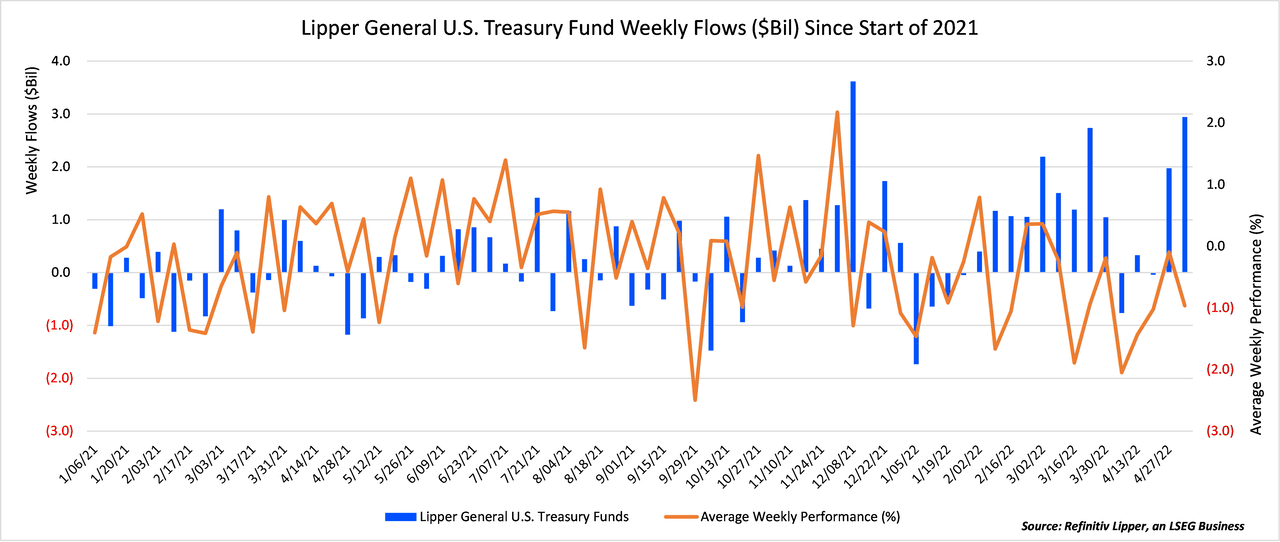

Even with the poor comparative overall performance, the classification led the way this previous fund flows 7 days, attracting $3. billion. Lipper Basic U.S. Treasury Resources have also been purple hot because the get started of the year, pulling in $21.4 billion, producing them the third most common Lipper classification in that span – powering only Lipper Global Profits Resources (+$33.4 billion) and Lipper Bank loan Participation Resources (+$25.2 billion). Lipper General U.S. Treasury Money also established a quarterly ingestion history in the course of the fourth quarter of 2021 as they noted inflows of $13.9 billion.

Lipper Standard US Treasury Money (Author) Lipper Typical US Treasury Fund Flows (Creator)

Wednesday, May perhaps 4, the Federal Reserve policymakers made the decision they will increase rates by 50 basis factors (bps) for the to start with time in extra than 20 decades. Whilst the significant hike was largely predicted, Federal Reserve Chair Jerome Powell pointed out that greater moves have been not in the Fed’s upcoming programs. It is nonetheless forecasted, nevertheless, that the Fed will raise costs throughout every of its remaining conferences this calendar year.

With the poor effectiveness of for a longer time-dated Treasury bonds already recognized via April, inflationary fears expanding, and the present-day mounting charges environment in place, the query stands: Why have longer-dated U.S. Treasury Cash captivated so substantially money this 7 days and this yr?

To get the response we could will need to get a action again. Fairness marketplaces year-to-date by way of April have logged even even worse returns than Lipper U.S. General Treasury Cash – Nasdaq (-21.2%), Russell 2000 (-17.%), and S&P 500 (-13.3%).

The only U.S. broad-primarily based fairness index to outperform the classification was the DJIA (-9.25%). As curiosity premiums increase, the large-flying, currently dear expansion and know-how stocks are in for a rough journey. Principal safety, tax exemptions, and assured prices of return come to be even a lot more significant as the economic climate looks to be heading towards turbulent periods.

Hazard mitigation and diversification are two terms that have appeared to have grow to be fewer captivating through the previous bull market. Goldman Sachs’ financial workforce just final thirty day period forecasted there is now a 35% probability of a U.S. economic downturn above the upcoming two a long time.

Deutsche Financial institution, which initially printed its economic downturn base case as late 2023, has said a downturn by the end of the yr is most likely if the Fed continues its intense monetary tightening. In buy to avoid huge drawdowns in a broader portfolio, an allocation to Treasuries functions as an alternative to diversify possibility.

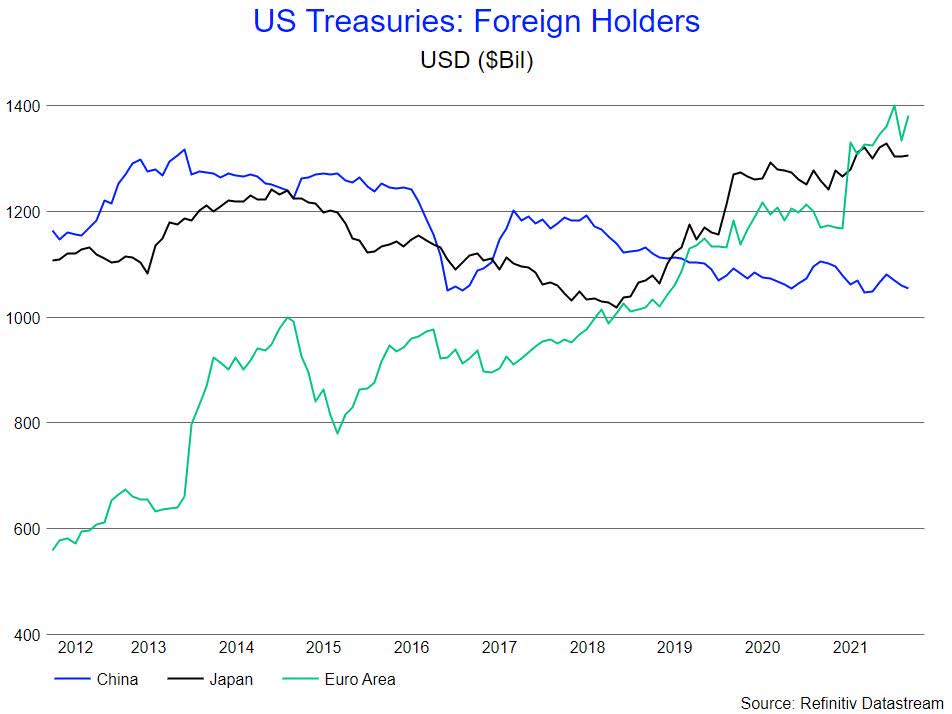

A 3rd viable pro of this Lipper classification in the specified ecosystem is the reality that market place contributors may well believe today’s rates currently issue in the long run anticipations of growing fees. If that is the scenario, and yields increase a lot less than expected, the scenario for keeping extended-time period bonds is a sturdy 1 – a stance several overseas buyers are betting on.

US Treasuries (Writer)

Editor’s Note: The summary bullets for this article ended up preferred by Trying to get Alpha editors.

[ad_2]

Source connection