Mobile household dwellers hit even more durable when going through eviction

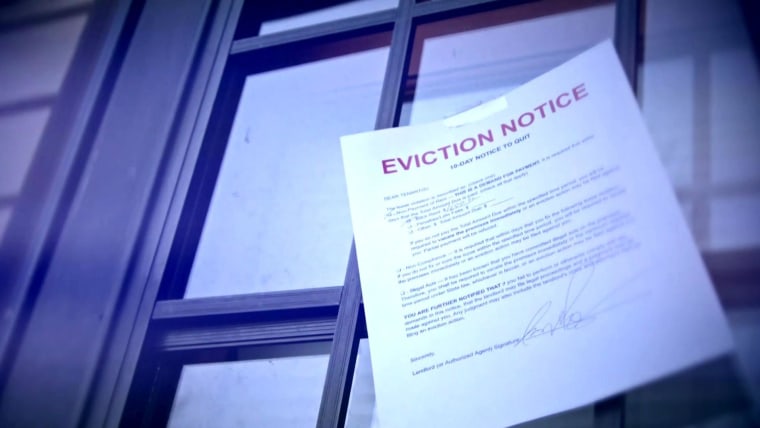

Chris Larson was making ready lasagna for Christmas Eve dinner very last calendar year when another person knocked on the door of the cell property he owns with his fiancée, Kirsten Brokaw, and a few kids in Remarkable, Wisconsin. An apologetic male dressed in denims and a jacket stood at the door, handed him a stack of papers and said he was being evicted. He claimed the family members had to go away by Jan. 20.

“We had been working with up all the income we experienced to shell out down our lot lease,” Larson reported. “We tried out to keep up the finest we could until eventually then.”

Like hundreds of hundreds of other persons nationwide, Larson and his shortly-to-be wife fell guiding on lease very last 12 months as the coronavirus ripped throughout the place. The family’s monetary problems began when Brokaw suffered a stroke in March, leaving her unable to perform. A couple of months afterwards, Larson lost his task as a truck driver. By December, the relatives experienced fallen four months behind on rent and owed a lot more than $4,700 in overdue large amount payments, taxes and late costs to the cellular home park’s operator, termed Homecroft Mobile Residence Park, in accordance to court documents reviewed by NBC News.

“I am going to lose my residence over a handful of months of lot rent,” Brokaw claimed. “I truly feel like we are getting rid of it all and all the challenging work we did that obtained us to this issue.”

Homecroft Mobile Dwelling Park, which is shown on the web site FostoriaReserve.com as 1 of its 3 communities in Ohio and Wisconsin, declined to comment on the case.

Cost-effective housing advocates have celebrated the Biden administration’s extension of the Facilities for Illness Management and Prevention’s moratorium on evictions as a critical go that could assist folks battle to stay in their residences as the pandemic continues to gut the economic climate. But the get includes loopholes that fiscally stretched landlords have been ready to use to eliminate tenants who tumble powering on rent. Housing advocates say a single of the most difficult-hit teams has been cell home park dwellers like Brokaw and Larson, who were now surviving with a constrained protection web to drop back again on. Just before the pandemic, quite a few cell home residents, like Brokaw and Larson, experienced juggled having to pay for their cell houses and for the loads they sat on. When they come across by themselves facing eviction, they chance dropping not only the ton but also their household fairness.

“In several instances, the tenant has 30 days to depart the large amount. But how do you expect a person to pay a tow business $5,000 to $10,000 to detach their home from the home and reinstall it someplace else?” reported Stuart Campbell, a staff members law firm at Authorized Aid of NorthWest Texas, who has been doing work on a regular stream of mobile residence eviction conditions by way of the pandemic. “Frequently when they are evicted for large amount rent, they’re forfeiting the equity on the home. You could shed your residence for $1.”

Starter households

Right before the pandemic, manufactured residences, the modern term for cellular households, experienced come to be significantly well-liked housing choices for family members with confined indicates who have been wanting for the facilities of the suburbs on smaller budgets, Campbell said. For an ordinary of a lot less than $1,000 a thirty day period in most elements of the place, a loved ones can live in a 1,400-sq.-foot, pet-helpful house with a driveway, a garden and, maybe, a neighborhood swimming pool or a park, in accordance to the Manufactured Housing Institute, an market trade group. With long backlogs for economical housing, quite a few households battling monetarily have discovered produced houses to be persuasive alternate options.

“You get extra bang for your buck,” Campbell explained.

There are 8.5 million produced households in the U.S., nearly 10 per cent of the country’s housing inventory, in accordance to the Produced Housing Institute. The median home cash flow of a loved ones residing in a manufactured housing park is $30,000 a year, according to the institute.

“There are lots of determinants on exactly where you dwell — I want to be shut to loved ones, I want to be close to my work,” reported Kevin Borden, executive director of MHAction, a nonprofit that advocates for manufactured housing tenants. “And there also all those people non-aspirational determinants — suppressed wages, deficiency of access to credit score for gals and girls of color. Made house communities seriously are this special affordable landing spot no make a difference what fuels your selection.”

Locating room

The Superior property marked a new starting for Larson and Brokaw. The few had been living in a three-bedroom condominium with their kids in Carlton, Minnesota. But Brokaw was determined to find a larger dwelling for the loved ones. She labored 100 to 120 several hours a week as a dwelling wellness aide until eventually she was 38 months expecting with her youngest daughter to save funds.

When Brokaw and Larson located the Fostoria Reserve Homecroft Mobile House Park, they had been hopeful. They moved into a 4-bedroom, two-bath household in a safe and sound and handy neighborhood in a good college district. The good deal payment was about $525 a month, and the park provided funding to buy the $52,000 household through 21st Mortgage loan at $525 a thirty day period.

But what seemed like a steady economic route to very own their home swiftly unraveled in the pandemic-stricken financial system. If they are evicted, they will have little recourse to recover the roughly $12,000 they have previously invested in shelling out for their house.