New company models, large option: Monetary expert services

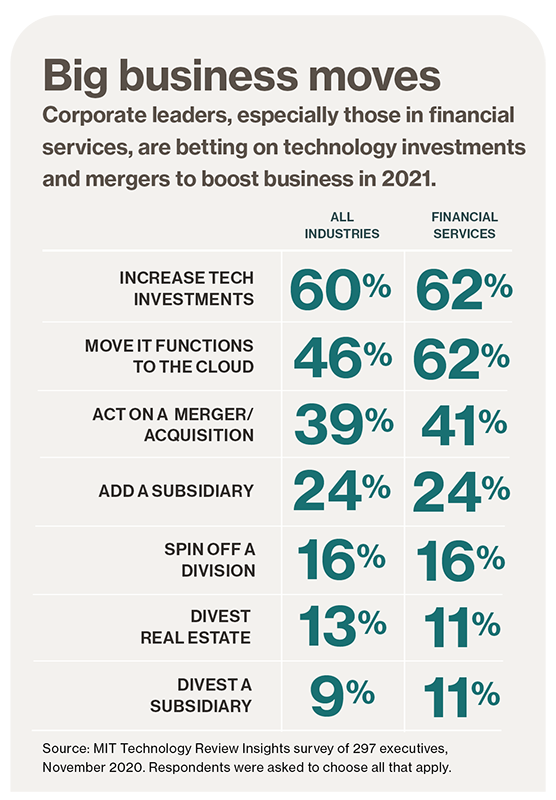

More enthusiastic than at any time, organizations in all industries are ready to slice costs that absence a clear return on investment. So it is no shock that survey respondents spotlight computing projects—all extremely measurable— as priorities in their 2021 options. Among the financial companies establishments, 62% are on the lookout to ramp up tech investments, and another 62% assume to shift IT and company functions to the cloud, in contrast with 46% across industries. In a the latest report, Nucleus Investigation identified that cloud deployments produce four times the return on expense as on-premises deployments do.

Preparing past the pandemic

The Guardian Existence Insurance policies Firm of The us is an exemplar of a progressive cloud adopter—it’s now transferring many of its main economic techniques to the cloud. The insurer was determined to do so—an interior research had found many prospects, like inadequate information administration, a require for lower-stage details for better analytics, a deficiency of procedure integration, and guide reconciliation problems. “These agony details aided make the will need for a new program,” claims Marcel Esqueu, assistant vice president for financial methods transformation at Guardian. “We appeared at transferring to the cloud about five many years back, but we did not consider it was all set.” Now the enterprise deems cloud products and services mature sufficient to assistance the innovative features it demands.

Economic institutions are also seeking at mergers and acquisitions as a route outside of pandemic survival. In truth, according to a Reuters report, such promotions were being up 80% in July, August, and September 2020 from the prior fiscal quarter to hit a whopping $1 trillion in transactions. In the MIT Engineering Critique Insights survey, 41% of fiscal products and services execs report that their organizations acted on a enterprise merger or acquisition or will do so over the coming 12 months.

“People have realized they have to have to consolidate to produce more powerful and far better-equipped businesses to offer with what the earth appears to be like heading forward,” suggests Alison Harding-Jones, running director at Citigroup, in the Reuters report.

Mergers and acquisitions have extended been a way for an firm to expand its main business—or even get knowledge in emerging systems. For illustration, whilst quite a few financial institutions acquire business software program with built-in synthetic intelligence (AI) capabilities, Mastercard acquired a Canadian AI system business identified as Brighterion in 2017 to offer “mission-crucial intelligence from any facts source,” states Gautam Aggarwal, regional chief technology officer (CTO) at Mastercard Asia-Pacific. The corporation first utilized Brighterion’s engineering for fraud detection but now puts it to do the job in credit scoring, anti-revenue laundering, and the company’s internet marketing initiatives. “We’ve actually taken Brighterion and used it not just for the payment use case but over and above,” suggests Aggarwal.

Business enterprise modify, outdoors and in

Certainly, companies have had to innovate and answer quick to endure in the covid overall economy. In the survey, 81% of corporations across industries have evaluated new business enterprise styles in 2020 or are setting up to start them about the following year. Amid monetary providers establishments, improving upon the customer experience is paramount, with 55% reporting that they’re enhancing the working experience they present their consumers, compared with 35% throughout industries.

Which is genuine for Jimmy Ng, group chief data officer (CIO) at Singapore-dependent DBS Bank. When bodily branches shut throughout lockdowns, DBS customers— like other financial institution patrons the world over—did their banking on the net. But some of them did so only due to the fact they experienced to. “The query is whether this group of individuals will keep on being on the electronic channel.” So DBS is discovering techniques to maintain customers who want in-human being assistance engaged, discovering technologies such as augmented and digital fact and the 5G cell community, which allows superfast connections. “How do we permit a joyful shopper journey in this distant way of engagement?”

Obtain the total report

This written content was made by Insights, the tailor made content arm of MIT Technology Critique. It was not published by MIT Technological know-how Review’s editorial workers.