Open up Finance offers key alternatives for economic expert services

About 4 out of 10 people in the Uk really feel anxious, concerned or pressured about their financial problem. In accordance to a report by Woodhurst, Open Finance has the electrical power to reduce some of this anxiety, get worried and strain.

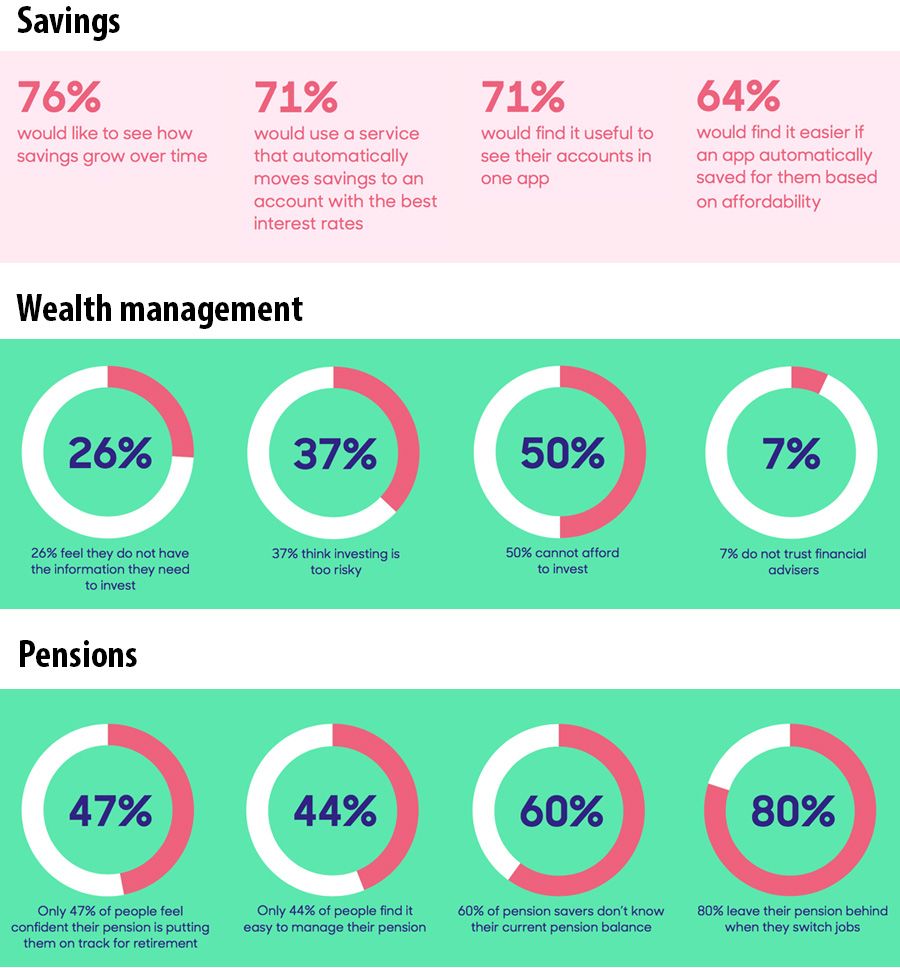

Open up Finance considers how buyers will be ready to just take regulate of their information and conveniently execute payments throughout all places of fiscal providers so that new, innovative options can be made. It is an extension of the open up agenda outside of only Open Banking, to encompass financial savings, investments, mortgages, credit history, pensions and insurance, for both folks and firms.

The variety of people today and little companies that have employed Open Banking products or services much more than doubled in 2020 – around 2 million customers have now actively engaged with banking options that present an increased stage of account data, or initiate payments, using Open Banking APIs.

This is heralded as a accomplishment story, and for the most component it should be – 2 million stop buyers are benefiting from this innovation throughout banking. Nonetheless, this nonetheless only represents close to 4% of the consumer banking inhabitants of the Uk and according to the analysis by Woodhurst, 38% of individuals however aren’t informed of Open Banking as a principle.

Open Finance

This is where Open Finance arrives in. By extending the use of open info further than classic payment accounts to an individual’s total monetary landscape, the likely value to customers is exponentially increased. Open up Finance puts manage back again in the fingers of the purchaser, but it also provides organisations the electrical power to make their customers’ economical lives much easier and significantly less nerve-racking.

If embraced across the industry, Open up Finance can cut down biases that are inherent throughout the monetary business, support monetary training for all clients, not just the privileged number of, and market monetary inclusion.

But to certainly uncover the likely of Open up Finance, the scientists argue that a amount of techniques requirements to be taken. For starters, “We need to highlight, with precise detail, the products and answers that are staying developed now, to display how Open Finance can considerably enhance customers’ economic life,” explains Josh Rix, a Director at Woodhurst.

In its report, the authors present an overview of the full Open up Finance landscape these days, as perfectly as examples of products and providers that are currently searching to solve serious purchaser concerns.

“The actuality is that there is a flourishing ecosystem of progressive providers performing alongside established and ever-evolving money products and services providers,” states Rix.

Some businesses are tackling the problem of identity, authentication and consent, trying to find to develop a seamless way for buyers to access their info and complete steps on it in the most safe way possible. Others are weaving the threads of the market alongside one another by standardising the way in which information is sourced, analysed and dispersed – the two in reaction to and pre-empting regulatory pointers.

Rix: “And lots of are working with this larger availability of deeply insightful facts to develop new solutions and solutions for prospects or reshaping those people that currently exist. With a small direction, a lot of collaboration, and a focused, concerted energy these ingredient parts of the Open up Finance ecosystem can arrive alongside one another to generate added benefits for all buyers.”

As Harry Weber-Brown, Innovation Director of The Investing and Saving Alliance set it, “The ideal way for Open Finance to be shipped is if all organisations who are trying to test and fix specified pieces of the jigsaw puzzle do the job jointly.”

Realising the journey

There are a lot of stars that have to have to align to generate a genuinely open fiscal technique – Woodhurst determined 5 vital elements that the marketplace needs to consider to additional lay the foundations of Open Finance:

Outline a regular tactic for contextualised details sharing

In short, a in depth, standardised and universal approach to electronic identification would breathe everyday living into the thought of Open up Finance.

Aim on the price trade to generate consciousness and consumer education and learning

The aim need to often be on creating a optimistic exchange of price in between get-togethers. An end customer does not need to know that Open up Finance exists as a notion. They only will need to know that they have the opportunity to use a effortless, digital solution that tends to make their lifetime easier, in one particular way or a further. The mechanics are, and should normally be, irrelevant.

Embrace more regulation as an possibility and a business enterprise enabler

Regulation is inevitable. Organisations necessary to comply with these regulations should check out them only as an chance to strengthen the small business, the current market and the field as a whole. This too, ought to foster an natural environment of collaboration among the business and regulators, which will ultimately guide to smoother implementations.

Recognize that there is a compelling small business scenario for modify

The Open Banking, Open up Finance and Open Information initiatives might breed level of competition, but, when framed correctly, they can result in a beneficial scenario wherever every participant rewards. “Open Finance can assist item providers cut down working price tag, boost efficiency and de-possibility the business as perfectly,” according to Vaughan Jenkins, Director of Business enterprise Improvement at MoneyHub.

Look at digitisation as a action on the path to Open up Finance

To build excellent client activities, enhance product choices and improve operational effectiveness, organisations will have to embrace electronic. Some embarked on this journey prolonged back, and many new entrants to the marketplace know nothing at all but digital. The many smaller providers for whom the strategy is seen as very alien have to have to contemplate the wider organization circumstance and the terrific positive aspects that can be reaped by means of treading the route of Open Finance.

“Although it might be a slow burn up, the economic services field is setting the standard for how facts can be shared across the entire digital ecosystem in a safe and safe way, to travel important gains for proven financial vendors, new entrants to the sector, and individuals alike. It definitely can be win-acquire-gain,” concludes Rix.

For more data, download Woodhurst’s ‘Uncovering the Likely of Open up Finance’ report.