Return to Business: London Goldman (GS), JPMorgan (JPM) Bankers Lead Return

Soon after a lot more than a year of in the vicinity of-vacant skyscrapers and virtual conferences, the City of London is hoping the U.K. government’s hottest lockdown steerage following week will support kickstart a far more common return to the office environment.

Banking institutions like Goldman Sachs Group Inc. and JPMorgan Chase & Co. have informed U.K.-primarily based personnel that workers should really all set on their own for a gradual return to workplace from later this thirty day period. All those ideas could change if Prime Minister Boris Johnson announces an extension of the remaining lockdown constraints in England on Monday.

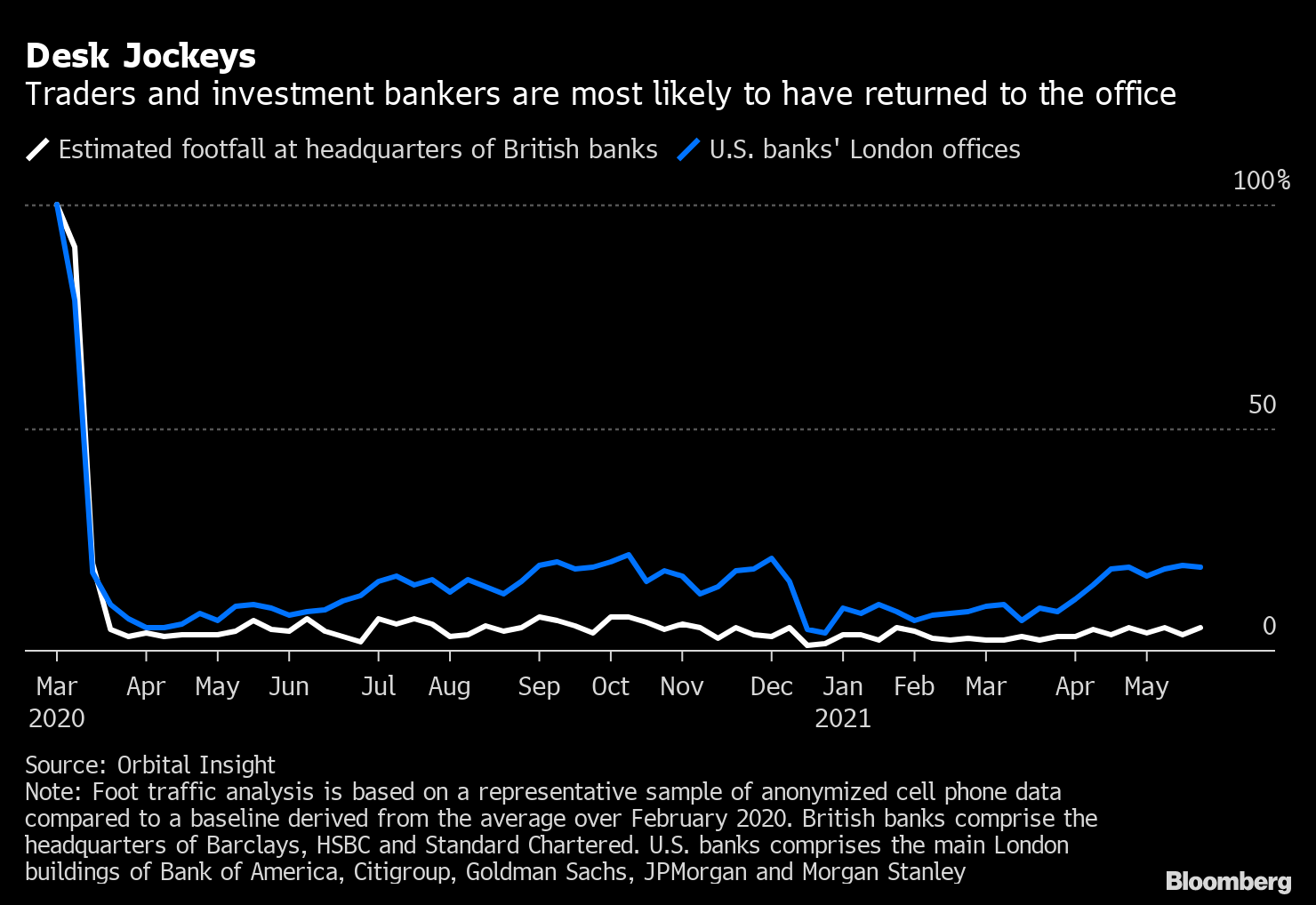

Even if Johnson unlocks, these hoping for a speedy return to pre-pandemic norms may possibly be unhappy. The scale of any return is unlikely to be dependable across the exact firm, allow by itself the broader marketplace, in accordance to estimates of foot traffic concentrations because the onset of the pandemic by facts system Orbital Insight.

If you’re a trader or an investment banker, you’re extra probably to soon come across oneself commuting in — if you have not already returned. But other spots of finance could continue to be quieter.

Desk Jockeys

Traders and financial investment bankers are most possible to have returned to the office environment

Source: Orbital Insight

Foot targeted visitors stages in the most important London offices of Lender of The usa Corp., Citigroup Inc., Goldman Sachs Team Inc., JPMorgan Chase & Co. and Morgan Stanley, which have a significant proportion of traders and expenditure bankers amid their headcount, have been believed on typical to be about a fifth of the pre-pandemic norm as of Could 24, according to Orbital’s evaluation, which monitors action levels by satellites and mobile mobile phone data.

Visitors at British banking institutions like HSBC Holdings Plc and Normal Chartered Plc, whose buildings have more employees concentrated on retail operations and head office environment things to do, was considerably less than 50 % that amount, in accordance to Orbital.

Study extra about how the U.K. is returning to operate

Spokespeople for the banks declined to comment on the calculations.

Or take Barclays Plc’s two structures in London’s Canary Wharf district. At the British bank’s headquarters on Churchill Position, footfall was about a tenth of a pre-pandemic baseline in late May, according to Orbital. In the separate making that residences the lender’s expenditure lender, about a fifth of employees were being current.

A Barclays spokesperson said the Might details didn’t mirror the present occupancy level in London as the bank’s phased return to the workplace, specially in the company and financial investment bank, started off in June. The loan company has also been employing back-up premises so some employees generally based in the London workplaces are now onsite in other places.

Buying and selling Buzz

“It’s extremely hard to replicate the excitement of the investing space in one’s household, but there are other roles in finance that require head-down, uninterrupted aim, exactly where workers operating from residence may fare much far better than they had in the office environment,” reported Allison English, deputy main executive officer of workplace investigate business Leesman.

The point so a lot of locations of finance are effectively-suited to distant function could have big implications for the myriad corporations that supported the Town of London when 50 percent-a-million commuters employed to flood into the central London district just about every day. They’re very likely to continue on to wrestle till a broader cross-segment of finance return to the place of work.

The tone from the top rated may possibly also be driving some of the variances. Goldman Sachs’ London developing — at about a third full — is the busiest of all the corporations in Orbital’s investigation. The firm has been a notably vocal proponent for a return to the pre-pandemic model with Chief Executive Officer David Solomon contacting it “an aberration that we are going to correct as speedily as possible.”

Read through far more: Lender bosses want a return to workplace. Underlings are not so sure

By distinction, executives at British and European financial institutions have commonly been additional supportive of adaptable doing the job for workers. HSBC’s Noel Quinn has promoted hybrid functioning, Jes Staley claimed Barclays would steer clear of a “demanding mandate” on any return to the office and Regular Chartered has formalized flexible performing preparations for most of its team. Retail-concentrated NatWest Team Plc explained it expected just 13% of its workers to operate mostly from the office right after the pandemic.

‘Clear Contrast’

“There is a distinct contrast rising in the tactic of the U.S. banks in contrast with the U.K. and Europeans,” explained David Harding, a senior affiliate at consultancy Innovative Place of work Associates. “While the U.S. banking companies are setting out their tone from the leading and proclaiming the value of their in-office tradition, there is far more of a mixed look at amongst the U.K. and European banks.”

Workers enter the European headquarters of Goldman Sachs Group Inc. in London.

Photographer: Chris J. Ratcliffe/Bloomberg

This kind of range of techniques and attitudes means there’s unlikely to be an industrywide consensus anytime soon all around the fiscal workplaces of the long run.

“The finance sector is designed up of this sort of a wide assortment of roles that it would not be accurate to generalize that the operate they do would be much better at their households or in their offices,” mentioned English.

— With guidance by Marion Halftermeyer, Lananh Nguyen, Jennifer Surane, Jeremy Diamond, Harry Wilson, and Hannah Levitt