Significant 4 accounting firms rush to be part of the ESG bandwagon

The sustainability boom has moved trillions of pounds into environmental, social and governance resources and introduced a new stakeholder-led agenda to corporate boardrooms.

Now the Large Four accounting companies are leaping on a bandwagon that offers two tempting prospects: an enlargement of what organizations have to account for, and a probability to rebrand a scandal-plagued career as industry experts on local weather transform, variety and successful consumers’ have confidence in.

PwC put the booming need for ESG guidance at the coronary heart of a $12bn investment program it announced in June that will include introducing 100,000 workforce and launching “trust institutes” to teach shoppers in ethics.

Bob Moritz, its world chair, reported the investment would redefine and rebrand the organization “to make guaranteed we’re important for what our shoppers need and what the globe needs”.

Deloitte, in convert, declared a “climate learning programme” this month for its 330,000 workforce. KPMG’s ESG operate has provided serving to Ikea to analyse social and environmental dangers linked to the Swedish furnishings retailer’s uncooked supplies, and advising on the to start with eco-friendly bond issued in India.

Together with EY, all 4 have been at the desk as business enterprise teams check out to thrash out new intercontinental specifications for measuring sustainability.

But as their new ESG concentrate looms much larger in their marketing, some companions concern the extent to which it will renovate their organizations and alert that it might expose the companies to a backlash if they are unsuccessful to stay up to the benchmarks they encourage.

The Major Four are responding in part to a increase in clients’ budgets for acquiring internet zero emissions options and other sustainability initiatives. Tracking nonfinancial metrics these kinds of as companies’ carbon footprints, and not simply their fiscal effects, presents them a prospect to generate extra price revenue and improve revenue margins.

The introduction of standardised ESG reporting metrics for businesses would also build more operate for accountants. This will likely be facilitated by the proposed Worldwide Sustainability Expectations Board, a human body that could be designed by November to mirror the purpose the International Accounting Criteria Board performs in placing financial reporting standards.

“One of the problems the job has faced . . . is that the audit or economical statements were being considered by some as a compliance perform,” explained a previous senior lover at PwC.

“If [companies] appear at something as a compliance or commodity buy they grind the price tag. If they search at it as one thing that adds price, they are ready to spend the correct rate for the price that the provider supplier presents.”

Outside of accounting, the ESG craze also presents the Major 4 other options.

There will be expanding potential to cross-provide knowledge these as incorporating local weather-associated conditions to the design of government spend deals, a spouse at one more Large Four agency said. The amount of world-wide companies that include environmental or social metrics when selecting executive fork out has already doubled since 2018, according to the most up-to-date once-a-year report from ISS ESG.

The goal of PwC’s “New Equation”, which involves a rebranding based mostly on “trust”, was to seize on an “inflection point” as providers contemplate how to clarify their effects on modern society immediately after the pandemic, said a man or woman briefed on the ideas.

As an alternative of only “answering the issue we are asked”, it needs to “frame” clients’ thoughts and enlist PwC teams with abilities related to other stakeholders this kind of as staff, the individual included. Consultants advising corporations acquiring new know-how, for illustration, could help to guidance personnel who threat getting rid of their employment as a final result, the individual explained.

That consultants and accountants see ESG as a industrial opportunity is distinct. Considerably less obvious is no matter whether the scale of the adjustments in their organisations will match the marketing hoopla.

At occasions, the firms wrestle to articulate what their aim on broad principles this sort of as “trust” and “sustainability” suggests in apply.

Punit Renjen, Deloitte’s worldwide main government, recently posted a tweet about an posting by some of the firm’s senior thinkers on “the url involving trust and economic prosperity”.

“Trust is all-encompassing,” the piece declared. “Physical. Psychological. Digital. Fiscal. Moral. A great-to-have is now a will have to-have a principle is now a catalyst a worth is now a must have.”

The “climate finding out programme” is Deloitte’s newest local climate-linked initiative. For all the promotion, it quantities to a 35-45 moment on the internet presentation, a handful of interactive things and an invitation to staff to lower their particular local weather affect.

Although the Big 4 emphasise local weather modify and equality in their advertising and marketing and recruitment products, significantly of their expenditure is in unrelated locations. PwC’s method announcement concentrated heavily on “trust” and “sustainability” but a lot of the $12bn it options to make investments will go toward two other key advancement prospects: know-how and Asia.

The bulk of its 100,000 web new careers are envisioned to be in know-how, capitalising on desire from providers searching for enable with cyber safety, cloud platforms and data science. Only some will relate to ESG PwC has not presented a number.

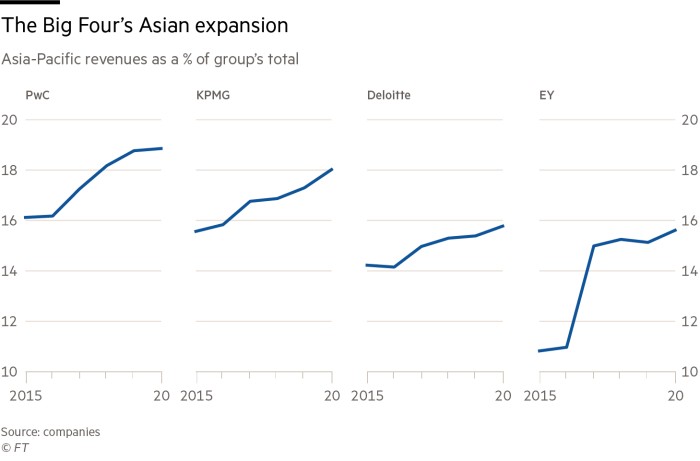

A quarter of the new investment decision will go in the direction of doubling PwC’s company in Asia, in which the consulting industry alone has grown by a third given that 2015 to $32.9bn, in accordance to Source World-wide Analysis, but accounts for considerably less than 15 per cent of PwC’s revenues.

On the other hand, regardless of the excitement about local weather and social effects, consulting firms’ ongoing interest in other development possibilities indicates they recognise that ESG suggestions will not displace, or even reshape, all of their present operations.

They are also pushing deeper into sustainability consulting regardless of critics boasting that the outperformance of ESG-themed procedures is illusory or will be shortlived.

Two Harvard professors concluded this thirty day period that the US Enterprise Roundtable’s 2019 assertion heralding a new period of stakeholder capitalism was “mostly for show”. The roundtable’s members include things like the heads of the Major 4 accountants as perfectly as the competing consultancies Accenture, Bain & Company, Boston Consulting Team and McKinsey.

Even if they are hedging their bets by investing in engineering or regional shifts, leaping so publicly on the ESG bandwagon and keeping on their own up as beacons of rely on also carries danger for consultants.

“I think they will come to be a concentrate on for activists,” said the Uk handling husband or wife at one more accounting firm of PwC’s plans, arguing that by marketing its ESG credentials the firm would bring in scrutiny of its own document.

“It does not just take much . . . for anyone to uncover PwC in country X is not pretty complying with its personal carbon emissions [standards] or is servicing shoppers that have bought an awful profile or heritage of modern slavery.”

Questioned irrespective of whether PwC’s aim on believe in was a hostage to fortune given the scandals that have plagued its marketplace, Tim Ryan, chair and senior associate of PwC in the US, claimed: “There’s always a risk in major. We’re not fantastic but we’re massively investing to make sure all the things we do is to do with enhancement.”