Soon after US sanctions, Huawei turns to new organizations to boost sales | Company and Economic climate News

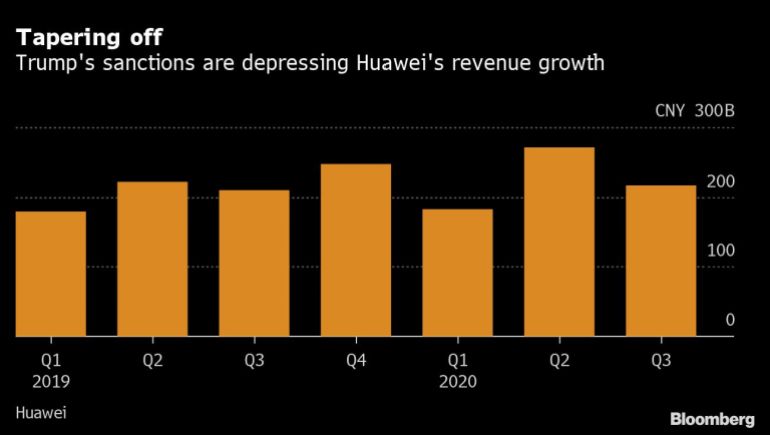

6 months immediately after the Trump administration dealt a crushing blow to Huawei Technologies Co.’s smartphone business, the Chinese telecommunications giant is turning to much less glamorous possibilities that may perhaps sooner or later offset the decrease of its largest income contributor.

Amid its newest prospects is a fish farm in jap China that’s 2 times the sizing of New York’s Central Park. The farm is included with tens of thousands of photo voltaic panels outfitted with Huawei’s inverters to shield its fish from too much sunlight though building energy. About 370 miles to the west in coal-loaded Shanxi province, wireless sensors and cameras deep beneath the earth monitor oxygen amounts and likely machine malfunctions in mine pit — all equipped by the tech titan. And next month, a shiny new electric powered auto that includes its lidar sensor will debut at China’s premier automobile show.

The moment the world’s greatest smartphone maker, the Chinese company has noticed a sequence of U.S. sanctions nearly obliterate its worthwhile buyer enterprise. With the Biden administration maintaining up the strain on Huawei, billionaire founder Ren Zhengfei has directed the company to mature its roster of company purchasers in transportation, producing, agriculture and other industries. Huawei is the world’s major provider of inverters and it is now banking on escalating those gross sales together with its cloud services and knowledge analytics methods to support the 190,000-staff organization endure.

“It’s quite unlikely that the U.S. will take out us from the Entity Checklist,” Ren mentioned final month at the opening of a mining innovation laboratory partly sponsored by Huawei. “Right now, we just want to do the job harder and retain looking for new prospects to endure.”

Ren reported the new initiatives may perhaps offset the drop in its handset business enterprise “more or fewer inside of this 12 months,” while the business declined to offer distinct figures. Its shopper device produced earnings of 256 billion yuan ($39 billion) in the to start with 6 months of 2020, more than fifty percent of the company’s complete. It managed “marginal growth” in product sales and income last year, many thanks to history 5G foundation station orders and potent smartphone income in the 1st 50 %.

Huawei has been discovering organization alternatives further than telecom gear and smartphones for years but the efforts took on new urgency immediately after mobile phone shipments tumbled 42% in the remaining a few months of 2020, largely due to a Trump-era order that minimize off its capacity to obtain the most advanced semiconductors. The Biden administration has also informed some suppliers of tighter disorders on beforehand authorised export licenses, prohibiting objects for use in or with 5G devices, according to people today acquainted with the move.

The U.S. ban has experienced restricted effect on Huawei’s rising businesses, as most of the components necessary are out there from Chinese suppliers, in accordance to a individual specifically associated in the initiative. To meet up with the rising demand from contractors together with Huawei, regional suppliers are squeezing greater effectiveness from mature technologies that Washington hasn’t banned, the particular person claimed, declining to be discovered speaking about interior matters.

The most superior chips in Huawei’s inverters, utilised to transform the electrical output from solar panels, depend on 28-nanometer engineering, which Chinese organizations are able of production. Other components, this sort of as ability modules, can be manufactured by 90nm technological know-how or more mature. Yangzhou Yangjie Electronic Know-how Co. and China Methods Microelectronics Ltd. are amongst the prime power diode producers in China.

Each individual inverter — somewhat larger than an out of doors device of a central air conditioner — can offer for in excess of 20,000 yuan, extra than Huawei’s most recent substantial-conclusion Mate X2 foldable cellular phone. The firm is arranging to roll out extra of its photovoltaic inverters, as Beijing’s drive to have carbon emissions in the world’s 2nd-biggest economic climate peak by 2030 drive investments in renewable electricity.

Like its photo voltaic inverter organization, the chips expected for Huawei’s automotive devices are significantly less innovative than cellular phone processors and can partly be sourced from European suppliers, in accordance to a person man or woman common with the make a difference. That’s authorized Huawei to double down on the car or truck marketplace, transferring engineers from other enterprise units to operate on sensors for self-driving cars and power models for electric powered autos.

Whilst the company has denied it options to launch EVs beneath its have manufacturer, Huawei’s worked with quite a few producers to take a look at its autonomous driving and driver-vehicle interaction systems. Its enjoyment functions can be identified in Mercedes-Benz sedans and the company has teamed up with domestic electric powered auto makers this sort of as BAIC BluePark New Electricity Technological know-how Co. to develop good vehicle units. The first product below its partnership with the Chinese EV maker, the Arcfox αS HBT, will be unveiled at Automobile Shanghai 2021 in April.

Yet another initiative dubbed 5GtoB entails Huawei deploying 5G technology to areas ranging from health and fitness care to airplane producing. The enterprise has helped China make the world’s greatest 5G network, supplying a lot more than fifty percent of the 720,000 base stations running throughout the country. Now it’s in search of to use the country’s 5G connectivity to aid pandemic-strike corporations automate factory traces — becoming a member of fellow tech behemoths this kind of as Xiaomi Corp. and Alibaba Team Keeping Ltd. in striving to modernize manufacturing — and digitize at the time labor-intensive industries like mining.

Huawei has signed more than 1,000 5GtoB specials in much more than 20 sectors with enable from telecom carriers and partners, in accordance to rotating chairman Ken Hu. Online instruction, enjoyment and transportation are between the sectors it options to discover, he mentioned. The company in January gave smartphone czar Richard Yu a new job to shepherd its promptly-escalating cloud and AI corporations.

“The adoption of 5G in mining, medical expert services and production is having clearer and some of the purposes are becoming used nationwide,” Liu Liehong, vice-minister for market and info know-how, stated at an market function in Shanghai past thirty day period.

Huawei 5G routers are in use in mines [File: BLOOMBERG]

Huawei 5G routers are in use in mines [File: BLOOMBERG]

Ren is individually top the expansion into mining, conference with local officials and inspecting coal pits in Shanxi province. “Most info communications technologies companies did not feel of mining as a discipline the place they can make market place breakthroughs, but we did,” the billionaire explained to reporters final month. “China has all around 5,300 coal mines and 2,700 ore mines. If we can serve these 8,000-in addition mines very well, we could expand our solutions to mines exterior China.”

When Huawei’s betting that inverters, electronic mining remedies and wise vehicle software package may possibly compensate for the decline of smartphones, its longer-expression upcoming — and its skill to proceed powering China’s 5G roll-out — stays clouded. Its HiSilicon subsidiary experienced been the country’s most able chipset designer, earning the significant-close processors that electric power the company’s smartphones and wireless foundation stations, right before Washington reduce off obtain to the latest chip-structure program and agreement manufacturers these kinds of as Taiwan Semiconductor Production Co.

For now, the company has informed its wi-fi clients it has ample communications chips to guidance base station constructions in 2021. But it’s unclear how extensive individuals stocks can past, and what selections Huawei has at the time those people inventories at some point deplete.

“The ongoing political frictions have solid shadows on the organization functions of Huawei and other Chinese firms in the foreseeable upcoming and strategic financial investment in emerging systems is crucial to Huawei’s sustainable enterprise progress,” said Charlie Dai, principal analyst at Forrester Exploration Inc.