The ROI of automation in finance & P2P

Discovering the value in employing cloud and automation across your procure-to-pay (P2P) is the very first move. The future, is determining the monetary benefit to make a circumstance for adoption. To assistance with both, Basware have quantified the worth and return on financial investment (ROI) of cloud-primarily based P2P answers with the aid of investigate by Forrester Consulting.

Finance flexes its new muscular tissues

The job of finance is switching. For decades, CFOs and accounts payable stop-buyers alike were being course of action centered and customarily reactive in their roles. But offered the inflow of digitisation in the current market, finance teams have the power to be proactive, having on strategic ambitions these types of as investigating the profitability of business units, the business enterprise scenario guiding strategic investments, and the conditions of vital contracts.

In get to achieve these new goals, the finance operate will inevitably be faced with the realisation of one particular decisive detail – digitisation is crucial.

Embracing digitsation

Across procurement all the way as a result of to accounts payable, the even more digitised and cloud-based a company’s processes are (and as a result the additional procedure automation the enterprise has), the a lot quicker it will reach benefits such as:

- Cost personal savings

- Overall flexibility

- Details-centered insights

- Automatic software updates

- Sustainability endeavours

- Approach efficiency and handle

- Distant operate capabilities

And the force to do so is coming at a time in which these positive aspects aren’t just a wonderful to have, they are a requirement.

Prior to the pandemic, digitisation of business processes wasn’t considered essential to thriving continuity initiatives. But 2020 has revealed that digital infrastructure is important to producing a potent and resilient firms.

In accordance to research commissioned by BlackLine, the pandemic has reshaped the position of finance and accounting and revitalised the urgency around digital transformation. In reality, 40 p.c of respondents want to enhance monetary arranging, assessment, budgeting, and forecasting by way of automation about the subsequent calendar year. Moreover, 1-3rd of C-suite executives are arranging to employ or scale automation around the upcoming 12 months.

Digitisation is plainly a crucial ingredient in finance groups strategic ideas, but securing acquire-in from management, as effectively as with end-end users, to start implementation of automatic, cloud-dependent operations is a real challenge.

Cash talks

CFOs want responses to questions like “what’s the ROI?”and “what will we gain?”. Meanwhile, end-users want solutions to inquiries like “what improvements will this new technologies carry?” and “will automation and digitisation swap me?”

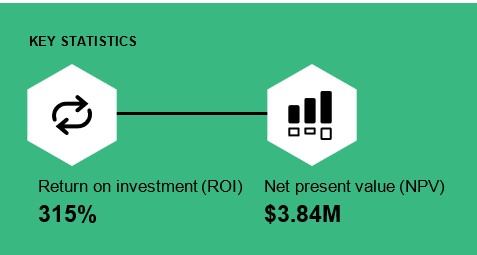

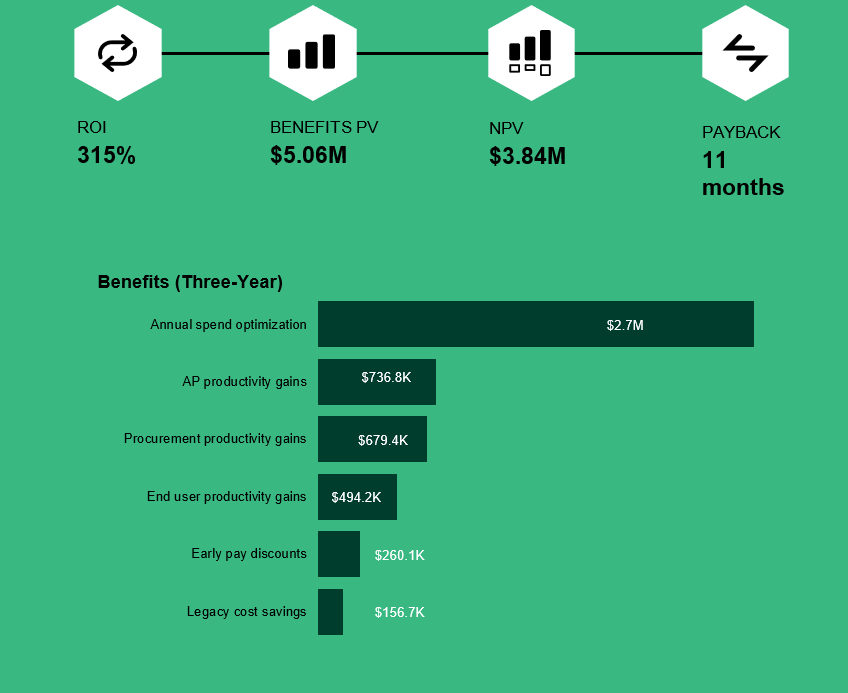

In purchase to reply these concerns and more, Basware teamed up with Forrester Consulting to carry out a Whole Economic Impact (TEI) study to analyze the possible ROI organizations could accomplish by deploying a cloud-dependent P2P solution. The investigate discovered that it’s feasible for firms to realise a 315 p.c ROI and a web current worth of $3.84m over a few a long time.

Forrester spoke with Basware buyers to much better realize their P2P automation journeys. Before implementing their cloud P2P options, many experienced from inefficiencies this kind of as manual, paper-dependent accounts payable processes and inadequate visibility of their procurement transactions.

But after implementation, they noticed rewards this sort of as streamlined invoices, elevated procurement and accounts payable efficiency, improved invest below management, minimized running prices, and amplified cost savings.

Key data:

Once-a-year expend optimisation – $2.7m

With Basware P2P, customers identified that procurement groups attained bigger visibility of obtaining behaviors, drove provider consolidation and introduced devote below management.

Accounts payable efficiency gains – $737,000

Due to the maximize in electronic invoicing, corporations can more correctly travel touchless processing of invoices by means of sophisticated matching and coding. This led to further efficiency will increase these kinds of as automatic validation, streamlined routing, and reduced provider inquiries.

Procurement productivity gains – $680,000

Enhanced sourcing processes and compliance led to massive efficiency gains, optimisation of resource allocation, enabling procurement workers to show up at to a lot more strategic duties.

Stop person productivity gains – $494,000

Time personal savings many thanks to automated matching and approvals build a extra streamlined accounts payable procedure and permits end-users to refocus their electricity on additional strategic final decision-building.

Early pay back bargains – $260,000

Corporations can decrease their bill processing situations using e-invoicing and automation. This straight-by means of processing indicates invoices can get paid a lot quicker, supplier inquiries answered speedier, and early shell out savings captured a lot more usually.

Legacy procedure routine maintenance value discounts – $157,000

By upgrading to the cloud, businesses ditch paper costs and demand negligible bill storage and logistics prices. IT departments can grow to be an integral section of the enterprise rather than an enabler considered as an obstacle or cost.

And though funds generally does the conversing, so do the unquantifiable advantages. With the digitisation of enterprise features not only preserving company’s funds, but also offering further benefits, which includes:

- Far better consumer ordeals

- Less difficult workflows and enhanced visibility

- Chance mitigation now and in the potential

- Increased concentrations of procurement investigation and chance mitigation

- Flexibility and scalability many thanks to a cloud-centered architecture

- Facts intelligence capabilities

- Improvements in RPA and AI to additional simplify finance and P2P

The true ROI of P2P automation

The benefits of P2P automation are clear – from both equally a quantitative and qualitative point of view. Finance departments are realising additional and additional that digitisation of their procedures and upgrading to automated, cloud-based remedies are no extended a pleasant addition, but a requirement.

Gartner investigation even uncovered that 60 p.c of polled CFOs concur that they will be spending a lot more time accelerating digital expertise in 2021, whilst 66 % say they will be dedicating a lot more time to RPA and workflow automation this 12 months.

Read the overall whole Whole Economic Impact™ (TEI) review and understand much more about all the advantages of automating, digitising, and upgrading your P2P to the cloud – right here.