Trump Firm, CFO Allen Weisselberg Are Billed With Tax Crimes : NPR

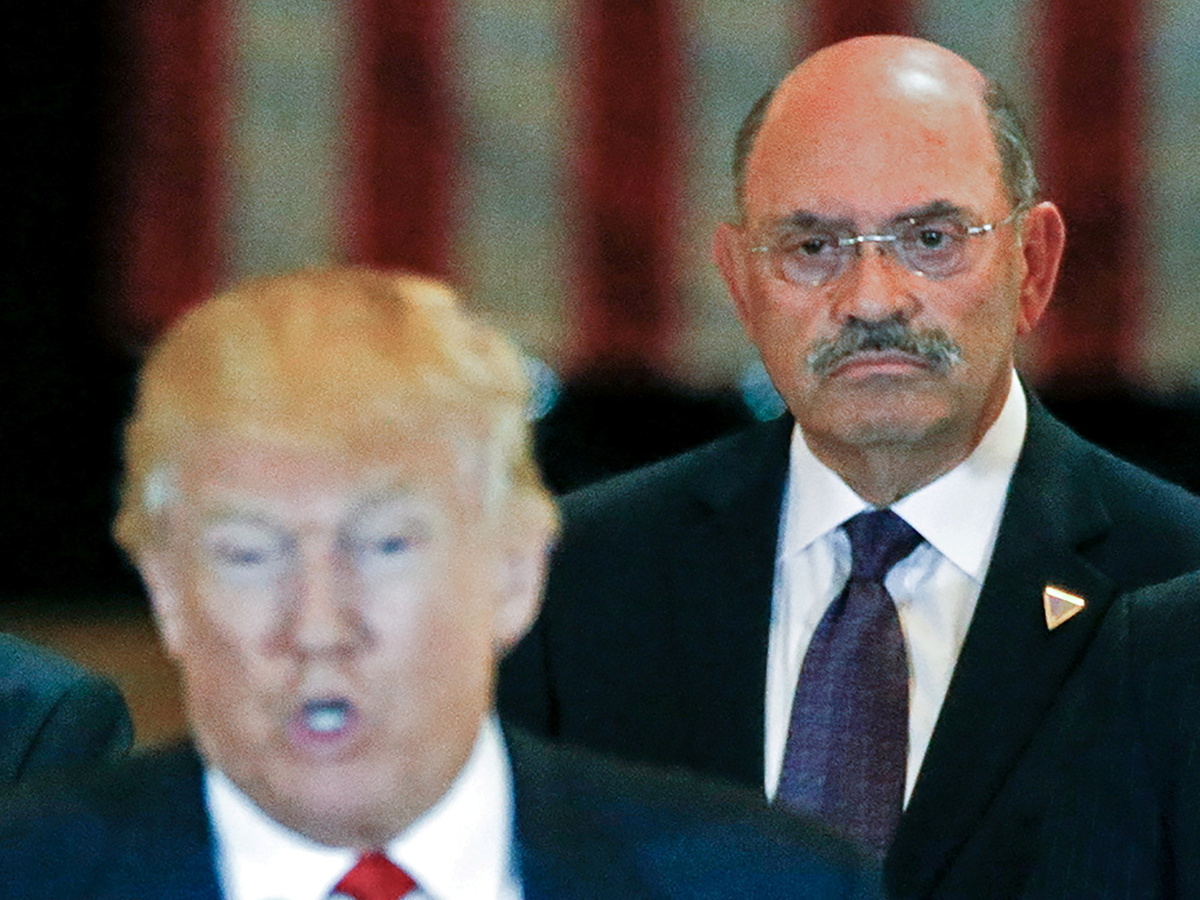

Allen Weisselberg, the Trump Organization’s longtime main money officer, with then-U.S. Republican presidential candidate Donald Trump in 2016. Weisselberg and lawyers for the Trump Group pleaded not guilty to prices Thursday.

Carlo Allegri/Reuters

disguise caption

toggle caption

Carlo Allegri/Reuters

Allen Weisselberg, the Trump Organization’s longtime main financial officer, with then-U.S. Republican presidential prospect Donald Trump in 2016. Weisselberg and lawyers for the Trump Organization pleaded not guilty to costs Thursday.

Carlo Allegri/Reuters

Previous President Donald Trump’s loved ones business enterprise and its longtime chief money officer, Allen Weisselberg, have been billed by the Manhattan district attorney’s workplace in a circumstance involving an array of alleged tax-linked crimes.

In an indictment unsealed Thursday, prosecutors allege that starting off from as early as 2005 and up until past month, the Trump Business and Weisselberg have dedicated tax fraud and falsified business data as aspect of a plan to compensate executives at the Trump Firm “off the textbooks.” The purpose, prosecutors declare, was to stay away from shelling out hundreds of 1000’s of pounds in taxes by compensating employees with lavish perks in addition to their common fork out.

Weisselberg allegedly acquired oblique payment — such as housing expenses, dwelling furnishings and leases for two Mercedes-Benz cars — with a total value of all-around $1.76 million and is accused of evading far more than $901,000 in federal, condition and community taxes combined. Private faculty tuition for two of Weisselberg’s household associates, in accordance to the indictment, was paid out with own checks signed by Trump. Weisselberg, an worker of the Trump Firm due to the fact 1973, is also alleged to have organized for a variety of Trump companies to make payments to him and to other executives as impartial contractors, conferring tax benefits on retirement accounts.

What if the Trump Firm is convicted of a felony?

Of the charges levied in New York State Supreme Courtroom, the most really serious a person struggling with Weisselberg is 2nd-degree grand larceny, a Course C felony that carries a most sentence of 15 many years.

The most severe demand for the Trump Group is legal tax fraud. A company observed responsible of legal tax fraud under New York law may well be fined “double the quantity of the underpaid tax legal responsibility ensuing from the commission of the criminal offense” or $250,000.

A felony conviction for the Trump Group would make it “quite tricky for them to do business enterprise,” including obtaining lender loans and particular insurance coverage policies, states Robert Gottlieb, a previous assistant district attorney in Manhattan who is now a prison defense law firm.

“There are many offers that an firm like the Trump Firm would like to enter into,” Gottlieb adds. “If it’s convicted of a felony, they’re gonna be barred by the governmental agency that supervises any unique tasks. So, they could be debarred from conducting sure firms. If convicted, the Trump Group is in incredibly, quite critical difficulty.”

Trump has prolonged denied any wrongdoing

Weisselberg and attorneys for the Trump Firm pleaded not guilty to the fees Thursday. During an arraignment in New York City, Weisselberg surrendered his passport and was launched without having possessing to write-up bail.

Trump has extended denied any wrongdoing. In a assertion Thursday afternoon, the former president said:

“The political Witch Hunt by the Radical Still left Democrats, with New York now having around the assignment, continues. It is dividing our Nation like never before!”

The investigation by Manhattan District Attorney Cyrus Vance Jr. began in 2018, around the time Trump’s former personal attorney, Michael Cohen, pleaded guilty to campaign finance fees related to payments of hush money. These were being designed in the remaining months of the 2016 presidential campaign, as Cohen place it in courtroom, “in coordination with, and at the direction of, a applicant for federal office.” The objective was to block two ladies who claimed they experienced extramarital affairs with Trump — former Playboy design Karen McDougal and adult film star Stephanie Clifford, whose stage name is Stormy Daniels — from telling their stories publicly.

New York point out Attorney General Letitia James’ workplace released its personal probe in 2019 soon after Cohen testified in a congressional hearing that Trump manipulated property values to reduced his tax obligations and to receive bank financial loans. James’ investigation was at first concentrated on prospective civil fees, but it a short while ago expanded to involve a legal probe in partnership with Vance.

This calendar year, the investigators have homed in on noncash payments made to prime officials in Trump’s businesses, which include Weisselberg.

The U.S. Supreme Courtroom paved the way for the fees, declining in February to block a subpoena from Vance’s business seeking Trump’s fiscal records. Vance to start with requested tax filings and other economical data from Trump’s accounting company, Mazars United states, in 2019.

In a statement released in May, Trump said the New York-based mostly investigations have been component of a “Witch Hunt,” introducing, with a reference to how his presidential campaign commenced in 2015: “It started the working day I arrived down the escalator in Trump Tower, and it is really never stopped.”