Volt Finance: Cross-chain asset bridge coming to Bitcoin SV

Uniswap is an Ethereum-based application that allows people seamlessly swap a single ETH-based digital currency for a person of the hundreds of countless numbers of other ETH-based electronic currencies that exist.

Amazing $ETH @ $730 … in the meantime network is trash. Tryin a metamask swap lol pic.twitter.com/vfONXLze7r

— CryptOrca (@CryptOrca) December 28, 2020

A token swap bridge is a excellent notion having said that, for the reason that UniSwap is constructed on Ethereum, it suffers from large transaction charges that can be hundreds of dollars when the community is encountering a ton of site visitors. These unreasonably superior transaction costs caused 1 Twitter consumer, @MrFrenchToast, to request the query, “why does bsv not have a Uniswap sort app and a bridge to eth?”

why does bsv not have a Uniswap variety app and a bridge to eth

— mrfrenchtoast (@mrfrenchtoast) December 28, 2020

To which the electronic forex wallet service provider Volt Finance responded declaring that BSV does have a Uniswap-sort app, that it is presently in creation, and that it will be referred to as the Vtoken Network.

Indeed, Volt is building a bridge(https://t.co/QVquYqzRDc) to migrate other assets to BSV ecosystem, @TokenSwap_professional is setting up an Uniswap like app on BSV with @BTokenProtocol

— Volt.id (@Voltfinance) December 28, 2020

The natural way, we experienced to learn much more about VToken Community. We had the chance to chat with Volt Wallet co-founder Wang Fuqiang, to study additional how Threshold signatures are utilised in Volt wallet, and what Wang Fuqiang believes more BSV developers have to have to do to be thriving.

What is Vtoken.Network?

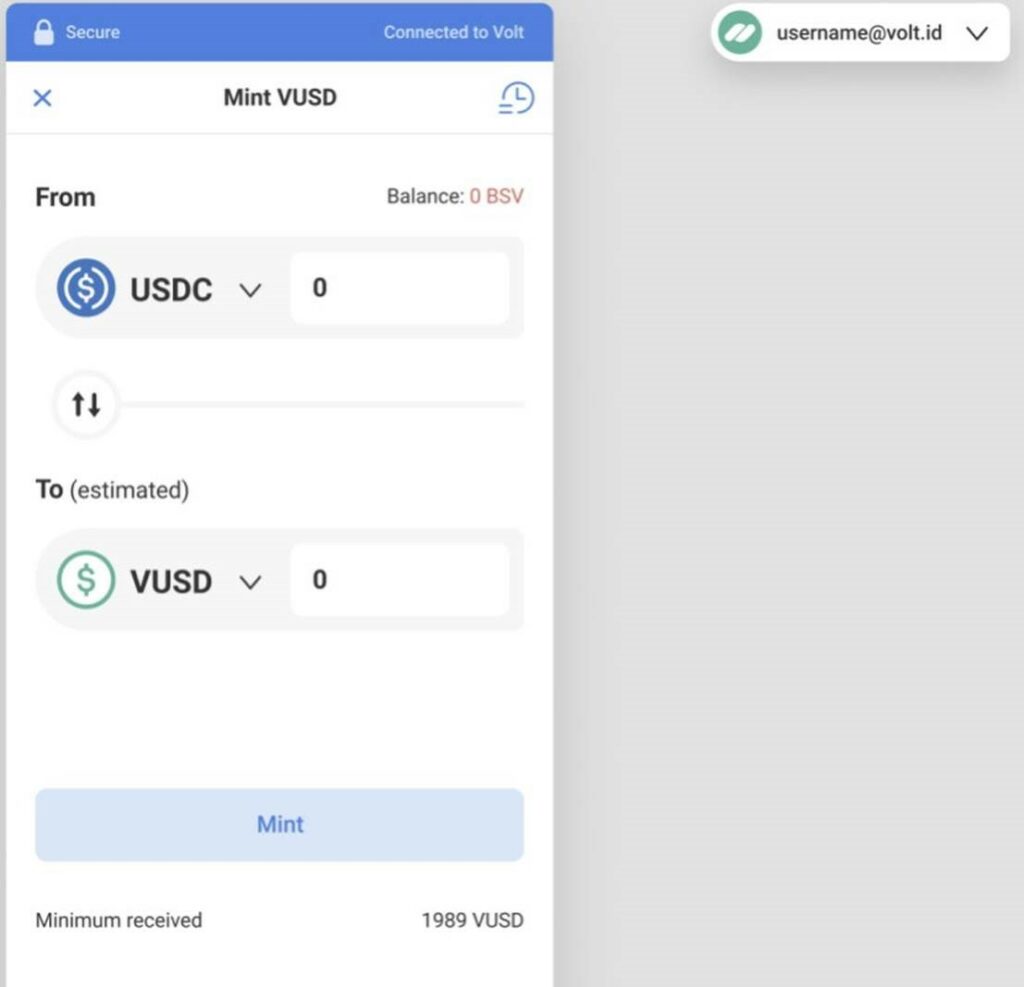

Vtoken.community is a cross chain asset bridge to carry other assets to the BSV community.

What electronic property will Vtoken.network help?

We are supporting USD Secure coin to begin with, BTC, ETH, LTC will be supported 1 by just one.

Can you give us an example of how a token swap on Vtoken.community will work?

Users will have to ship their asset (USDC, USDT, BTC, ETH, LTC, and many others) to an address managed by quite a few parties by way of threshold signature, and then the Vtoken issuance smart agreement will issue their respective edition of the asset on BSV just after the authentic belongings are sent to mint addresses. End users can also redeem their primary asset by burning Vtokens.

Is there an estimated start date for Vtoken.network?

Vtoken.network solutions really should be released in 2 months.

How does Volt wallet make use of threshold signatures?

Customers will have to ship their USDC, DAI, BTC, ETH, and so forth to addresses managed by Volt, Maxthon, and Showpay working with threshold signature, which ensures that no single entity can eliminate users’ money, this way, we can make certain Vtoken is backed 100% with actual initial assets.

How does Volt wallet regulate its buyer information when it will come to Picture ID and other personalized identification facts?

As explained right before, Volt doesn’t help you save customers electronic mail in a database, Volt doesn’t develop an email id + password to detect customers. Facial recognition information is stored only to make absolutely sure it is the authentic genuine user that is attempting to get better a wallet on a distinct unit. E mail + Facial recognition makes sure large amount of stability, it critically compromises stability if we select only email or only mobile phone amount as restoration credential.

What is your feeling on standardized and open protocols amongst wallets? Should each wallet do their have proprietary point or would it be much better for everyone to standardize?

There will be numerous token protocols, but as the ecosystem progresses, only 1 will keep on being aggressive. The relaxation will die out progressively.

How does Volt wallet program on controlling the wave of tokenization coming to Bitcoin SV? Will volt wallet aid tokens launch on Bitcoin? Will Volt wallet be interoperable with the token answers developed by other wallets? What is your plan in this regard?

Vtoken is the strategy, Volt will guidance BSV tokens, it is tough for Volt to assist all token protocols, we will only support the token conventional that is open up and has whole sensible contract ability executed in it.

Is there one thing you desire extra folks have been accomplishing to generate benefit and demand from customers in BSV?

BSV builders have to have to be sensible and down to earth, establish a thing that people use, prevent making stuff that no person uses. DeFi is real and it will only improve more substantial and even larger. BSV is a far better platform for further more development of DeFi, it will make no point to pointing fingers around to other blockchains as it doesn’t support expand BSV itself.

Blockchain/Bitcoin alone is revenue, its edge is to build a far better financial technique from infrastructure to top rated layer applications, what BSV top heads are declaring is DeFi is bullshit, which is turning a blind eye to what is seriously occurring.

On the 1 hand, they are expressing BSV can and will executing every thing other chains are executing, on the other hand, these similar folks are indicating BSV can not do this, BSV can not do that.

See also: CoinGeek Stay panel, The Foreseeable future of Exchanges & Trading in a Tokenized World

New to Bitcoin? Check out out CoinGeek’s Bitcoin for Rookies section, the supreme useful resource guidebook to find out more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.