Why it is Critical for Technology to Electrical power Your Company’s Accounting

A tech-powered accounting remedy usually means the use of data technological know-how to enhance the basic small business processes. It can be accomplished through integrated program answers which could be established up by the firm alone, via the software program as a services (SaaS) solution, or other cloud-primarily based method.

With no the use of accounting technologies in your China operations these days, your group will keep on being reliant on the in-home accounting staff or service vendor to sustain its tax compliance. This may perhaps be an inefficiency that your group can no extended manage to maintain operationally or economically, dependent on the mother nature of your nearby business.

When using standard procedures, facts in accounting documents can be of some use to management when generating important selections. On the other hand, if such documents are generated manually, their content material will inevitably be confined in terms of element, delayed in phrases of supply, and likely ‘siloed’ in a manner that helps prevent any systematic repurposing of the data. In this sense, the get the job done done is significantly less valuable, and the documents generally stand for a duplication of work – perform that can be accomplished more correctly and without the need of a great deal human intervention.

Importantly, finance and accounting know-how is no more time a high priced expenditure. Versatile platforms exist, which are frequently delivered for absolutely free by accounting providers to smaller corporations, or with only minimal upfront setup expenses. It is broadly acknowledged that in more compact company-oriented Asian jurisdictions like Hong Kong and Singapore, technologies is greatly leveraged by accounting industry experts to automate a variety of features of the get the job done. What is fewer identified, is the extent of a comparable advancement in China, and how modest and medium-sized companies can leverage know-how to enhance their operations a lot more very easily than at any time.

This is vital in China, because more compliance work is essential to sustain the accounts of a organization nowadays than at any time, which would in any other case signify far more guide administrative operate, draining time and sources. Luckily, technology remedies have rapidly produced guide administrative jobs ever more redundant.

For instance, the increased adoption of e-fapiaos (e-invoices) is reducing a whole lot of the workload relating to the issuance and receipt of paper files. In the coming yrs, we can anticipate extra businesses to be capable to perform in a ‘paperless’ accounting surroundings.

As this transformation carries on, providers that have not started out to adopt know-how in their accounting procedures will find themselves at a significant drawback in two crucial respects. Both of those relate immediately to speed:

• Velocity in operate processing. Your consumers, and even your staff members, will have greater anticipations in terms of the efficiency with which administrative tasks can be processed.

• Speed in reporting to administration, and depth of depth readily available.

Pace in get the job done processing

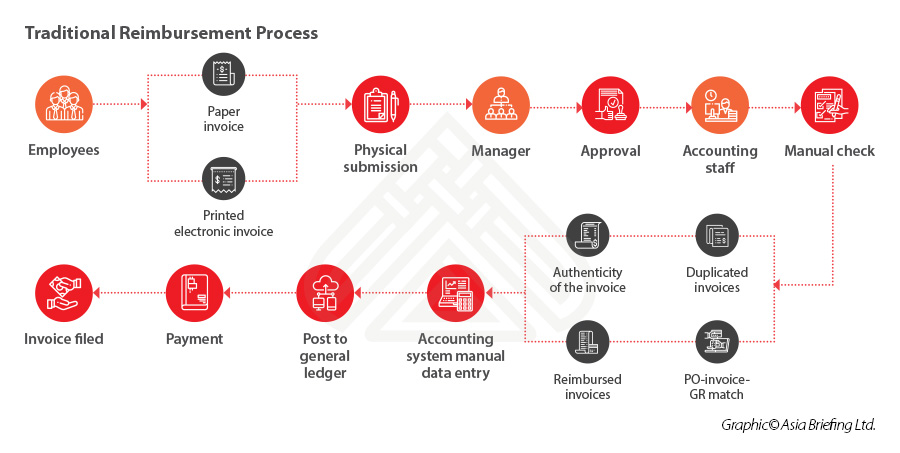

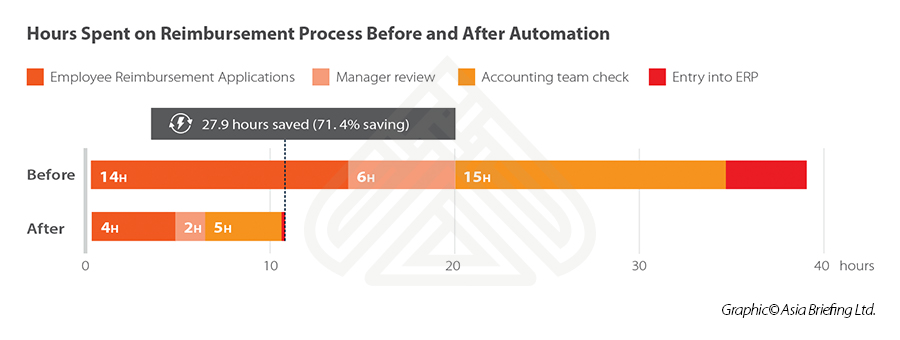

To illustrate the initially place, let us think about the time invested by your personnel organizing documentation to make their month to month reimbursement claims. For several workers, specifically these who vacation a large amount, the month to month course of action can get a few of hours. This consists of arranging all the relevant documentation and printing it all out. Manually entering figures line-by-line on an Excel sheet. Allocating the proper job to just about every price tag. At last, checking anything and then physically publishing the done document, or a lot more likely scanning the document and sending by email to the supervisor. It’s a monotonous course of action, and some personnel know that their supervisor is unlikely to go by a similar monotonous course of action to check out each expense, and as a result, tend to conserve time by omitting sizeable facts on the price statements.

From the viewpoint of the supervisor as very well as other important stakeholders that are interested in this information and facts, such as internal accountants and auditors, wading by these paper paperwork is also a time-consuming challenge. Figuring out prospective complications is unnecessarily tricky mainly because they are buried in a sea of unstructured details. Even though this kind of a methodology can legitimately be referred to as an internal handle system, it is so cumbersome to put into practice that it in all probability cannot be pretty powerful.

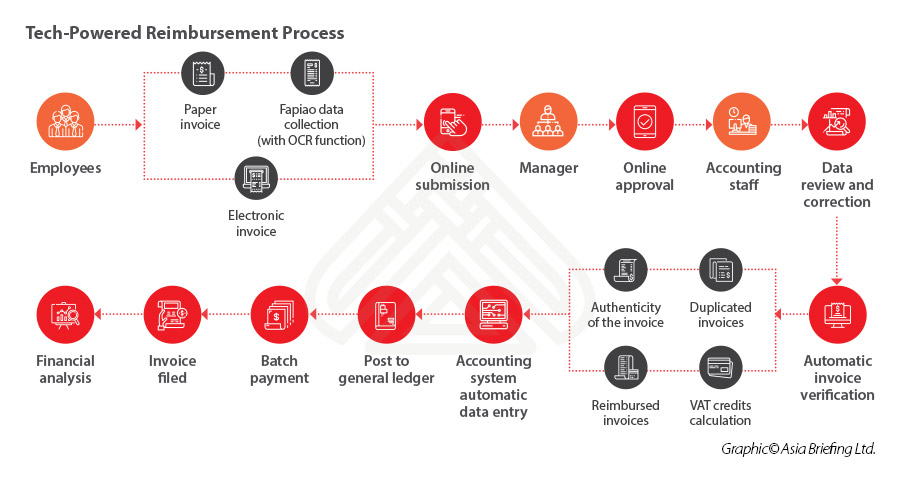

Contrast this with a methodology in which related paperwork and the crucial info on them are captured routinely by workforce through their cellular telephones. That data is straight and instantly transferred into a line on an price report in digital variety, in a structure that makes it possible for the personnel to very easily complement with an clarification relating to the expenditure. Challenge allocation for each expense can be easily reached by a pull-down menu inside of the app. No manual calculations are necessary, so no calculations will need to be checked by the supervisor or the accountant. Submission can be produced by a person simply click within just the application.

The supervisor can evaluation instantly and approve (or far more importantly) reject instantly. Other stakeholders, such as auditors, also have full access to the details, which will allow them to do their employment additional proficiently.

Speed of reporting to administration

In phrases of pace of reporting to management, less than a traditional accounting model, an appropriate timeframe has usually been to offer historical month-to-month revenue figures a couple of days into the next thirty day period, with the normal set of accounting reviews for consolidation delivered all around a week afterwards.

That handful of times that go ahead of the provision of the relevant reports in the accurate structure may perhaps not seem to be like a extensive time, but just about every working day represents a limitation for your corporation. During that period of time, there is a limitation in conditions of the sum of details that has been manually captured. Yet another limitation exists in conditions of the accuracy of the information and facts recorded owing to the inevitable occasional human mistake. Then, as a purely natural consequence of these two restrictions, the ultimate limitation manifests by itself in conditions of inferior reporting ability to the administration due to the fact of inferior volume and high quality of knowledge collected by this traditional methodology. Finally, the inferior quantity and top quality of reviews furnished to management limit their skill to make agile and exact company selections.

Below we search at how these details reporting and reconciliation of accounts may perhaps be achievable with minimum human intervention when preserving accuracy and performance, which will emphasize the big difference between regular solutions of accounting and the use of tech-powered application.

Bank account reconciliations

For firms with massive volumes of transactions in China, it may well be important for info displayed in these stories to be up to day. To attain that, very simple integration is demanded among the lender and the company’s accounting method, which is then integrated with the reporting function. In mainland China, this is not as clear-cut as is the circumstance in Hong Kong or Singapore. This is since banking institutions in China make it challenging to pull knowledge from their devices. This, nonetheless, is modifying. Dezan Shira’s team has been concerned in coming up with this sort of financial institution integration solutions for shoppers as lengthy ago as 2014.

Companies with reduced volumes of transactions may favor to skip an built-in technique but established up an automated regular monthly reconciliation method. Financial institution statements downloaded in Excel type can be instantly imported into the accounting process. Based mostly on a pre-identified logic in the accounting system, 90 percent of the reconciliation operate can be processed immediately. A little amount of money of guide do the job might be needed to recategorize a specific receipt/payment, or to dietary supplement some facts on a new seller/consumer. Once uploaded and processed, the accounting computer software will supply the account equilibrium info to the essential report routinely.

Accounts payable record

Practical facts, this sort of as how substantially money is owed to each and every vendor and what is the getting older program/accounts receivable getting old for each and every superb transaction, can be displayed on a searchable accounts payable listing. This info alone is delivered from a unique module of the tech-powered accounting software program, which in change gets populated immediately from the expense management application (on which far more will be stated in the up coming short article). As outlined previously mentioned, while making use of this sort of computer software, the reconciliation of payments will take place quickly from the financial institution statements that are uploaded. As a result, the details on the accounts payable listing is constantly and routinely mirrored in the new AP records captured from software program equipment, these kinds of as expense management apps. This suggests that reconciled payments are routinely dropped off the list.

Fastened assets list

Moreover accounting issues, administration also requirements to monitor the fastened property that the organization possesses. Significant thoughts in the course of audits involve: What information and facts does the business have about its mounted property? How far have they depreciated? What is the nature of these belongings? All this details can be pulled specifically from the preset belongings module of the tech-powered accounting program and exhibited on a mounted property listing.

Is it cost-effective?

Studying this posting, I picture that lots of people will be wondering that in truth a tech-enabled alternative would be wonderful, but it also seems like it would be prohibitively costly and challenging to carry out, specially in China. Really, that is not the situation.

Naturally, if your corporation would like to employ its very own tech-powered accounting software program with the essential IT infrastructure constructed from scratch, it is attainable. Nonetheless, these types of a important endeavor is time-consuming and might choose quite a few months to full.

Nonetheless, it is becoming much easier to love the positive aspects of tech-powered accounting with out going by means of these kinds of challenging procedures. For firms that use an accounting support service provider and really don’t have hugely intricate specifications in terms of processing or reporting, out-of-the-box options exist. For occasion, Dezan Shira & Associates features the model described in this short article to its consumers as a benefit-additional element of its common accounting provider in China. All the advantages of tech-driven accounting are by now there, at no additional price tag. Most shoppers are not even needed to invest in licenses for the tech-run accounting resolution that we are using, simply because the info on the reviews that we provide to them in authentic-time via SharePoint On line is previously satisfactory for their reasons. New customers can be onboarded in just a make a difference of hrs as it is effectively a SaaS resolution.

Case examine 1

A European trading firm (Business A) set up functions in China. Every thirty day period it was processing many hundred transactions, primarily relating to profits, to its purchasers. Corporation A expected to scale up further in the potential. The firm HQ was employing its personal global ERP and wished its China employees to produce order orders and income orders from this centralized system.

Problem

The business understood that configuring the HQ application in China to meet China’s unique accounting and tax requirements would be an pricey and complicated undertaking. At the same time, the firm understood that not finding any alternative would restrict the means of the Chinese entity to develop in dimensions and would also direct to challenges with tax compliance.

Solution

Info entered by Firm A in the source chain module of its world wide technique was exported by their IT staff quickly just about every thirty day period and shipped to Dezan Shira.

Dezan Shira configured a supply chain module for Organization A inside its tech-powered accounting software. This module was particularly built to combine with the client’s HQ procedure straight via import. Each individual month, the imported facts in the source chain module is processed according to China’s accounting and tax policies and as a result mirrored precisely in the finance modules of the tech-run accounting software package. Price of goods sold (COGS) calculations is of unique importance, as is VAT therapy.

All the stories for China’s statutory reporting uses are generated from Dezan Shira’s tech-run accounting computer software and subsequently submitted to the pertinent authorities. The stories for HQ are also produced from Dezan Shira’s tech-driven accounting software for subsequent add/consolidation into Company A’s procedure. Some of these reviews, as required, are created in accordance to the Worldwide Fiscal Reporting Standards (IFRS).

A localized expense management application does the significant-lifting work to capture all the necessary facts and manage Corporation A’s interior management approach for daily expenses and approvals in China. In a comparable way to the offer chain module information, the related information and facts is uploaded routinely from the expense administration application into the tech-powered accounting software’s account payable and common ledger modules.

To give Business A’s financial controller extra overall flexibility to see all the accounting details in just Dezan Shira’s method, Business A leased one particular license that enabled the financial controller to accessibility all specifics suitable to Enterprise A captured by the accounting application, which can be used by them to produce tailored experiences utilizing a impressive administration reporting instrument. The license price is charged regular, eradicating any superior upfront expense.

In this way, Corporation A realized all its goals at an upfront charge of only many thousand US bucks. That signifies a small fraction of what would have been vital to absolutely configure its possess software package to purpose as successfully in China. Leveraging a pre-current SaaS solution and making minor configuration modifications as essential is not only much less risky and significantly much less expensive, the timeframe for implementation is also considerably shorter. The higher than-pointed out option was set in spot inside of 3 months of the determination to put into action staying produced.

Scenario research 2

An Indian organization (Organization B) promoting obtain to its app via company to business (B2B) to clients in China required a way to correctly deal with its expenditures, difficulty official invoices (fapiaos) to its area clientele, full its statutory accounting operate, and be equipped to see apparent dashboards and metrics of all essential indicators suitable to the company’s functionality.

Problem

Firm B was properly a begin-up app developer, it did not possess a thorough tech-powered accounting method in area at HQ, nor did it have the time or the methods to acquire this kind of a method for its China entity. Corporation B was seeking for an powerful SaaS answer that could be put in area in just a person thirty day period, simply because it by now had considerable small business exercise in China and was anticipating more in the close to future.

Solution

Enterprise B leveraged Dezan Shira’s tech-run accounting application to be the central emphasis for all the details that required to be processed both equally for statutory and administration reporting reasons.

A localized price management app was chosen to competently seize all price details and enable professionals at HQ in India the needed manage to pre-approve payments dependent on information and facts furnished as a result of the application. Suitable details saved in the application was uploaded into Dezan Shira’s tech-powered accounting software and grew to become the supply data to routinely make the every month expenditure transactions.

On the revenue aspect, issuance of fapiaos was accomplished by storing the necessary shopper information and facts inside the AR module of Dezan Shira’s tech-driven accounting software program and linking it with China’s Golden Tax Process (GTS). As essential, information relating to product sales was sent to the GTS method in the structure needed, and then within the GTS system by itself, 1 simple instruction was designed to realize the VAT on the sale. At the time accomplished, fapiaos could be printed out utilizing the specified fapiao printer (Business B is not nevertheless applying e-fapiao methodology). After the allocation of fapiao selection by the GTS technique, the tech-powered accounting software package writes that quantity again into the AR module instantly.

All the statutory accounting and reporting work was dealt with within just the tech-powered accounting software program, with 80 p.c of the workload automated. Essential knowledge within the tech-run accounting software package was captured in near-to-actual time, and mirrored in a part of Dezan Shira’s Sharepoint On line web-site that was committed to Business B. Organization B’s specified personnel could occur on to this web-site to see up-to-date graphics and metrics relating to the China entity, and interact with our group in that house, in its place of relying on month-to-month reviews and e-mail interactions.

Company B was also scheduling transactions manually inside its administration accounting software program in India. Dezan Shira worked with Organization B to finish a Chart of Accounts mapping, and subsequently created a report that could be made use of directly to add into the Indian computer software.

In this way, the corporation was not only in a position to fulfill its rapid aims inside of a really limited period of time and with no any expense, it was also self-confident that a long run scale-up in its operations could also be obtained with out bumping up against speed restrictions imposed by gradual handbook processing do the job.

Locating a certified support provider

Service suppliers that are able to provide these kinds of technological know-how solutions should, of class, be tech-enabled them selves and have an inner team of experts available to deploy remedies for consumers at short recognize. Preferably, they really should have a solid keep track of document of having presently sent a vast range of products and services to organizations at a comparable stage of growth to your very own. They really should not only be ready to deliver a alternative, but also to coach your group on how to use it properly. And critically, the company provider needs to show that the circumstance manager for your account is able to perform carefully with your workforce and technologies gurus on an ongoing basis so that advancements are continuous.

(This report was initially posted in the journal, Optimizing Your China Accounting and HR Processing with Cloud Technological innovation, manufactured by Asia Briefing.)

About Us

China Briefing is published and produced by Dezan Shira & Associates. The apply assists foreign buyers into China and has completed so considering the fact that 1992 by means of offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Be sure to call the company for guidance in China at [email protected].

We also sustain places of work assisting overseas buyers in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our techniques in India and Russia and our trade investigation facilities together the Belt & Street Initiative.