Supplemental Steps to Boost Suspense Account Transactions Would Reinforce Fiscal Reporting

What GAO Discovered

Federal organizations use suspense accounts to temporarily hold financial transactions—such as transactions with missing or incomplete documentation—that call for further more exploration right before they are forever recorded to the suitable accounts in an accounting technique. About the a long time, both of those GAO and the Office of Protection (DOD) Office of Inspector General (OIG) have described that DOD and the Protection Finance and Accounting Services (DFAS) have lacked the controls necessary to account for and crystal clear suspense account transactions thoroughly. This has contributed to unreliable economical facts as the underlying transactions are not appropriately recorded in the accounting records.

Though DOD and DFAS have taken ways to align their suspense account policies and procedures with applicable federal advice, GAO observed that they had been inadequate, outdated, and inconsistently executed. For instance, in March 2020 DOD issued a policy memorandum requiring its component companies to clear aged suspense account balances—those more than 30 times old—by June 2020. If parts could not appropriately study and obvious these balances, factors have been instructed to remove the balances from suspense accounts by transferring them to other accounts. While these efforts reduced the aged balances by around $30 billion, assistance on the distinct steps to take out the balances was not delivered. The lack of specific advice contributed to parts inconsistently taking away aged suspense account balances and increased the danger of transactions not staying recorded, reconciled, taken out, and documented in a consistent and well timed manner. As of June 30, 2020, DOD’s suspense account harmony was $1.6 billion, of which $366 million was additional than 30 days previous.

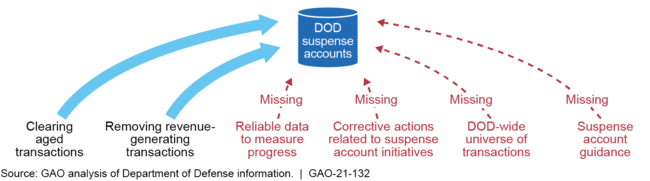

DOD and DFAS have carried out initiatives to very clear specific types of non–suspense account transactions from suspense accounts and lower suspense account balances. GAO observed that these initiatives did not recognize and tackle the root will cause of DOD’s suspense account control deficiencies.

DOD Steps to Tackle Deficiencies with Suspense Account Transactions

Not creating corrective steps to address the extensive-standing manage deficiencies with suspense account transactions has an effect on the dependability of suspense account balances in economic experiences, even while the balances are substantially lesser than they were in preceding fiscal a long time. Without having these kinds of corrective steps, massive suspense account balances could when yet again accumulate and a further pricey compose-off could at some point be necessary.

Why GAO Did This Research

DOD remains the only major federal agency that has been not able to obtain a economical audit opinion. One contributing factor is DOD’s prolonged-standing manage deficiency in suspense account transactions.

GAO was questioned to review DOD’s suspense accounts and establish their impact on DOD’s consolidated fiscal reporting. This report examines the extent to which DOD has (1) recognized and carried out policies and strategies for recording, reconciling, and clearing suspense account transactions at the DOD consolidated level and (2) resolved recognized deficiencies in recording, reconciling, and clearing suspense account transactions that may well influence the trustworthiness of DOD’s economical data.

GAO reviewed DOD and DFAS guidelines and treatments, interviewed DOD and DOD OIG officials, and reviewed initiatives similar to suspense account transactions.