Weekend Insights: International Tax Troubles

For weeks, the tax earth has been buzzing about the G-7 Summit and what it could necessarily mean for multinational companies.

G-7 is shorthand for the Group of 7 nations, a consortium of rich produced nations around the world that have fulfilled frequently due to the fact the 1970s to explore world financial fears and initiatives. Now, the G-7 involves Canada, France, Germany, Italy, Japan, the U.K., and the U.S.

This thirty day period, the leaders of those people nations fulfilled in Cornwall, England, for the G-7 Summit. Those people in attendance involved host Boris Johnson (U.K.), Justin Trudeau (Canada), Emmanuel Macron (France), Angela Merkel (Germany), Mario Draghi (Italy), Yoshihide Suga (Japan), and Joe Biden (U.S.). Charles Michel and Ursula von der Leyen have been also current representing the European Union the EU is not a member of the G-7 but normally attends the summit.

Throughout the summit, those people leaders attended conferences and published joint statements on troubles affecting planet economies and other policies like local weather transform. And, not shockingly, a international tax deal was heart stage with appreciable desire centered on multinational corporate tax, transfer pricing, and electronic taxes. You can locate out far more in What You Will need to Know About the G-7 Tax Agreement.

It is a lot for tax practitioners to hold up with, which is why we have you protected with our Insights Roundup.

Swift Numbers Trivia

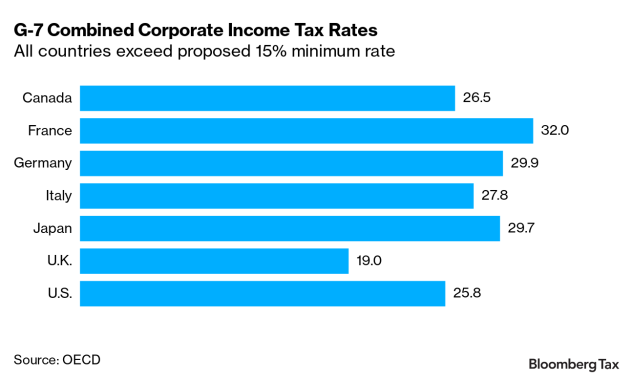

The G-7 has agreed in basic principle to a minimum global corporate tax rate of at the very least 15% on multinational corporations. How several of the G-7 nations around the world at this time have a corporate tax amount increased than 15%?

(Response at the bottom.)

Our Roundup

It is vital to retain up with worldwide tax moves impacting tax organizing, compliance, and enforcement. From minimal tax premiums to transfer pricing, here’s what our tax specialists are talking about this week.

The finance ministers of the G-7 have introduced their help for a world minimum amount tax of at least 15% and for the reallocation of specified income for big multinationals. In The G-7 Finance Ministers’ Announcement on Pillars One and Two: Does It Issue?, Jeff VanderWolk of Squire Patton Boggs considers the implications.

For extra on the G-7 tax settlement, test out this week’s episode of Chatting Tax, G-7 Tax Agreement Was Significant, But Now Comes the Challenging Section.

This spring, the U.S. federal government proposed scrapping the OECD necessity that only automated electronic solutions and consumer-dealing with enterprises would be involved in Pillar Just one, the OECD’s proposal for taxing the electronic economic climate. In Section 1 of a two-component post, Taxing The Leading 100, Lorraine Eden of Texas A&M University illustrates how the U.S. proposal would create an incentive to on a regular basis restructure multinational enterprises to slide outside of the Top 100. In Element 2, Eden demonstrates that the U.S. proposal to use the Top rated 100 multinationals enterprises could be impractical to administer because of the consistently modifying membership.

The increase of tax technological know-how owes much to the progress and implementation of AI technology. The digitalization of financial transactions on cloud platforms introduced changes to our office and every day lives. The electronic financial system also introduced an unprecedented sum of details beforehand unavailable to every person. In Technological innovation for Transfer Pricing, Shan Sun of Unilever PLC, examines the challenges and alternatives these alterations deliver.

Digital belongings convey new tax problems to international tax techniques. In Tax Difficulties of the New Electronic Assets—and their Treatment method in Portugal, Rogério M. Fernandes Ferreira of RFF & Associados points out how special, identifiable electronic property these kinds of as non-fungible tokens elevate questions and discusses their latest therapy in the Portuguese tax framework.

Closer to residence, domestic organizations are even now battling to get better from the pandemic. Challenges are relief programs keep on to make information.

The pandemic created distant get the job done necessary for a lot of corporations exactly where it could have been only an occasional practice. Quite a few staff members made the decision they liked it. Quite a few companies commenced contemplating decreasing their business place fees. In What is Your Approach? Staying away from Tax Pitfalls of a Remote Workforce, Jennifer Weidler Karpchuk and Katherine Noll of Chamberlain Hrdlicka wander by the tax concerns and how to prepare for an expanded or additional long-lasting remote workforce.

The Restaurant Revitalization Fund offers reduction to dining establishments and other qualified companies with gross receipts from income of foods and drinks. In Key Takeaways of the Cafe Revitalization Fund, Sofia Cordero of Mazars points out how the program operates and the necessities to participate.

The IRS has issued official guidance on staff retention credits (ERCs). In IRS Problems Notices With Updated, Formal Assistance on Staff Retention Credits, Isabelle Farrar, Alec Oveis, and Joshua Thomas of Ropes & Grey LLP explain how the credit operates, and how corporations can just take advantage concurrently of both of those Paycheck Security System (PPP) financial loans and the ERC.

PPP loans elevated quite a few questions for organizations and tax specialists. You can hear more about the start of the plan, its potential, and initiatives to prevent pandemic aid fraud in a current episode of Speaking Tax.

Generate for Us

Bloomberg Tax Insights articles are published by tax specialists presenting pro investigation on recent challenges in tax practice and coverage, tax developments and subject areas, and tax and accounting firm follow and management. If you have an interesting, never ever-published post for publication, we’d appreciate to hear about it. You can speak to our Insights team by emailing [email protected].

Highlight

This week’s spotlight is on tax professor Leandra Lederman. Lederman is the William W. Oliver Professor of Tax Regulation and Director of the Tax Software at Indiana College Maurer University of Legislation. As a tax professor, she operates the Indiana/Leeds Summer months Tax Workshop Series with Prof. Leopoldo Parada from the University of Leeds. She has also co-authored publications on tax controversies and company taxation, published about 50 articles or blog posts, and is a person of the 10 most frequently cited U.S. tax students.

Student Crafting Opposition

Imagine you have the “write” things for Bloomberg Tax Insights? We’re enthusiastic about our inaugural Bloomberg Tax Insights producing opposition, supposed to emphasize the quite finest of scholar producing. Because of to a flurry of current submissions, our deadline has been prolonged to June 30, 2021.

Run with Us

All set to blow off some steam after a very long (long) tax year? It’s not as well late to sign up for our virtual 5k. Operate as speedy as you want—or consider a walk just to take pleasure in the refreshing air—and earn a awesome medal. And considering the fact that #TaxTwitter loves its waffles, pancakes, and other breakfast meals, we’re paying it ahead by donating the proceeds to Earth Central Kitchen to fight hunger. You can signal up here.

Speedy Figures Answer

All seven.

Exclusive Content material for Bloomberg Tax Subscribers

As the electronic economy is turning into the world wide economic system, traditionally non-electronic corporations are creating improvements and generating new commercial choices under no circumstances prior to found. In this specific report from Baker McKenzie’s world tax follow, you will discover an overview of electronic technological know-how developments that all non-digital companies are incorporating, which interact with the crucial tax traits companies must actively navigate. You’ll also obtain situation research concentrating on Healthcare, Consumer Merchandise & Retail, and the wide Industrials and Manufacturing sector, alongside one another with an overview of electronic-certain worldwide tax and transfer pricing development traits.

*Notice: Your Bloomberg Tax login will be needed to browse the specific report.

Extra Fantastic Tax Content

This is a weekend roundup of Bloomberg Tax Insights, penned by practitioners and that includes specialist investigation on current issues in tax practice and policy. For a entire archive of articles, browse by jurisdiction at Each day Tax Report, Everyday Tax Report: Condition, Everyday Tax Report: Intercontinental, Transfer Pricing Report, and Monetary Accounting.

You can also follow Bloomberg Tax on Twitter, Facebook, and LinkedIn.

What Did You Feel?

We hope you identified Weekend Insights precious. We’d really like to listen to your tips for building it extra pleasurable. Here’s our email: [email protected]. Thank you for looking at!